Vital Farms

Q3 22’ SUMMARY

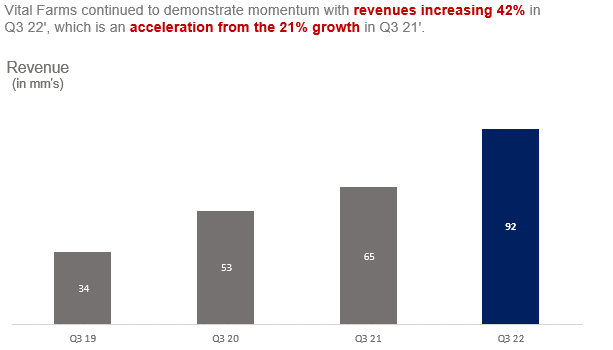

Vital Farms delivered revenue and earnings growth that exceeded management’s guidance and consensus estimates. This was driven by the business’ continued execution of its powerful go-to-market strategy consisting of a unique product at premium prices. Vital Farms successfully implemented material price increases across the portfolio of products, which is a testament to the high consumer demand for the business’ products as the price spread was already multiples the price of conventional eggs. Additionally, the business continued to drive growth from increased distribution in the form of doors, shelf space, and SKU’s carried. On the expense side of the business, Vital Farms realized immense growth in profitability driven by scale and expense normalization.

The business is a major benefactor and beneficiary of the health conscious megatrend in the egg industry. While the business is only in 8mm households, it has managed to secure the number 2 spot in the egg industry driven the premium consumers pay for Vital Farm eggs. In Q3, the convergence between natural channel shoppers and mainstream channel shoppers continued to occur as behavior continues to trend towards health conscious consumption. Vital Farms has a solid position in the expanding industry, which gives strong support for a positive outlook going forward.

“Vital Farms continues to challenge food system norms and deliver strong results. Our brand has maintained its positive momentum, as exemplified by 28% year-over-year volume growth during our third quarter, outpacing the category, which declined 0.5%. Our company produced both sequential and year-over-year gross margin improvement, and Adjusted EBITDA improved by $5 million relative to the same period last year.”

Key Takeaways from Q3 22’

Key Takeaway 1- continued foundational advancements

Vital Farms drove strong farmer network growth, which is a significant enabler of growth as the business is capacity constrained.

Vital Farms drove strong distribution point growth with emphasis on the Northeast market, which is under-penetrated compared to other markets.

Egg Central Station 2.0 launch has been successful, which positions the business to double revenues.

Key Takeaway 2- continued demand realization

Revenue growth was driven by material price increases across the portfolio of products.

Revenue growth was also driven by strong unit sales growth as aggregate demand increased.

Vital Farms’ drove immense growth in household penetration as the business scales.

Key Takeaway 3- massive shell egg tam

The entire egg industry is expanding as massive price increases are being absorbed by consumers.

Specialty egg unit growth continued to outpace conventional eggs.

Pasture raised egg unit growth continued to outpace every other segment.

GROWTH TRENDS

growth Factor 1- continued supply expansion

Vital Farms is still in the very early stages of scaling the business to maturity based on the current size of the business, size of the industry, and Vital Farms’ strong adoption rates by consumers aware of the brand. Despite having a fraction of the distribution as the largest egg brand, Vital Farms has achieved enough scale in terms of revenues to be ranked the #2 egg brand. This is highly indicative of the potential the brand has to scale to a national powerhouse in the commoditized egg industry. In order to do this, Vital Farms needs to increase the business’ capacity and distribution points as these are the greatest bottlenecks to achieving massive scale. Hypothetically, the business could multiply in size “tomorrow” if it had enough farms, retail distribution points, and shelf space. This is highly plausible as the underlying demand for the products far outstrips supply. Consumers are buying the products as fast as Vital Farms can supply them.

This setup makes Vital Farms a very interesting business. While the developed infrastructure will not be built “tomorrow”, the promise of demand that dwarfs current levels of revenue gives the business reason to push through the business development stages. Vital Farms’ business model is based on sourcing premium pasteurized eggs from family farms, preparing these eggs for commercialization, and delivering the eggs to grocery stores across the country. Additionally, the business model is based on selling these eggs from hundreds of family farmers under a single brand that resonates with consumers.

In Q3, Vital Farms continued to drive growth in each driver- farmer network, store count, processing capacity (ECS 2.0), and shelf space. The farmer network expanded materially on an annual basis, which enables Vital Farms to gather more eggs that are ultimately consumed as quickly as the business supplies them. While the farmer network remained pretty flat on a sequential basis, this is likely the result of the business focusing more on integrating newer farms rather than continuously adding farms every quarter. This is a great long-term tactic as it ensures that the network of farms operate in a consistent manner as they will have received adequate attention from Vital Farms at the outset. Going forward, management has communicated that the expansion activity has resumed in earnest with new farms being added each month.

The business successfully launched ECS, which is a testament to management’s ability to plan a major project and deliver on the plan in a timely manner. ECS is a major driver to the next stage of development as Vital Farms’ infrastructure building was limited due to the business being unable to handle more farmers or more stores. ECS has doubled the business’ capacity, which unlocks significant farmer and store expansion capabilities. This has facilitated an acceleration in store count growth in Q3, which now stands at about 1/3 of all grocery stores in the US. The store count expansion was also driven by several other tactics that Vital Farms has been employing for some time.

New stores were added in the Northeast region, which has been an area of focus for some time as this region’s footprint is much less than others.

Location expansions came from MULO (mainstream brands) stores as the business is developed in the Natural channel.

Vital Farms won additional locations from existing customers as the business continued to execute its expansion playbook consisting of beating and raising guidance given to retailers.

Shelf space gains also occurred in the quarter as well as stores picking up additional product SKU’s beyond the core SKU’s.

growth Factor 2- continued monetization momentum

Vital Farms’ capitalized on the strong infrastructure development as measured by egg revenue growth, sales per store, and sales per farm. Growing consumption by end consumers is the strategic counterpart to building supply capabilities. While being in stores creates material advantages as consumers shop brands that are easily accessible, simply being on the shelves is not enough to scale a business. Vital Farms continues to demonstrate that consumers have high levels of demand for the products, especially given that the product is priced much higher than other eggs. The business is growing monetization by demonstrating value to retailers as measured by velocity, which is a measure of demand that retailers use to compare products. Retailers use this metric to determine shelf space and SKU’s carried, which are major demand drivers. Although the store count growth materially drives revenue growth, sales in a given store is a material factor in aggregate demand.

Sales volume increased 28% despite material price increases across the product portfolio.

Consumers accepting price increases is a strong measure of demand for the products, which drove revenue growth.

Household penetration increased 40% to 8mm homes in Q3 22’.

Vital Farms’ launched the business’ first ad campaign to drive awareness, which increases probability of purchase when consumers visit stores carrying Vital Farms’ products.

Massive opportunity to expand purchase occasions, which is hovering around 3x-4x per year.

growth Factor 3- additional product opportunities

In Q3, Vital Farms’ butter business continued to contribute to revenues albeit to a lesser degree than the egg products. This business seems to have plateaued as Vital Farms has materially reduced resource allocation to development of the butter business. Given the limited TAM of the butter market, management’s decision to focus on the egg business is optimal. In Q3, management communicated that a new product will be announced in the very near future. This new product is designed to address an opportunity that is far larger than the butter TAM.

OPERATIONAL EFFICIENCIES

Vital Farms drove immense operating leverage in Q3 driven by gross margin expansion as well as OpEx efficiencies. The business has successfully navigated through the immense headwinds in recent periods driven by sharp increases in feed costs and freight rates. The business was in a difficult expense position in 2H 21’ and 1H 22’ as Vital Farms’ cost structure consists of paying farmers under a “cost-plus” model and paying material distribution costs from delivering product to thousands of stores. As expected, the business realized material operating leverage as these expenses normalized while the business continued to scale revenues. Specifically, the business drove material efficiency from implementing strong price increases in May 22. Overall, the business still has leverage ahead as the step-up in costs related to the launch of Egg Central Station in 22’ being lapped in 23’.

INDUSTRY TRENDS

Consumer spending on shell eggs continues to spike in 22’ driven by massive price increases. According to the BLS, egg prices increased 79%, 82%, and 58% in July, August, and September, respectively. This price growth has accelerated in October and November with growth of 88% and 109%, respectively. While growth of conventional eggs (54%) has outpaced specialty eggs (29%) in the six month period ending 9/30, this is driven by conventional egg price growth exceeding specialty eggs by a landslide. Even still, pasture raised eggs (39%) continued to outperform the specialty category, which was dragged down by the underperforming free range (20%) segment. Vital Farms (45%) continued to gain share with growth that exceeded the specialty category.

The trend of conventional eggs outperforming specialty eggs reversed when analyzing from a unit growth perspective. While conventional eggs growth was 54% in the six month period ending 9/30, the unit growth was -4% as consumer demand for conventional egg products pulled back. Specialty egg unit growth was 19% driven by a 26% increase in pasture raised units sold. This was driven by a 31% increase in Vital Farms unit sales as the business is the leader of the specialty category. Overall, this dynamic is driven by the megatrend of consumers shifting to products that are perceived as healthier and more responsibly sourced. These products are sold at much higher prices as supply is much lower than conventional eggs and consumers are willing to pay premium prices for specialty products. Producers are following the trend with production of conventional eggs falling from 84% of all production in 17’ to 66% of all production in 22’. Specialty egg production has increased from 16% of all production in the US to 34% in 22’.

FORECAST AND VALUATION

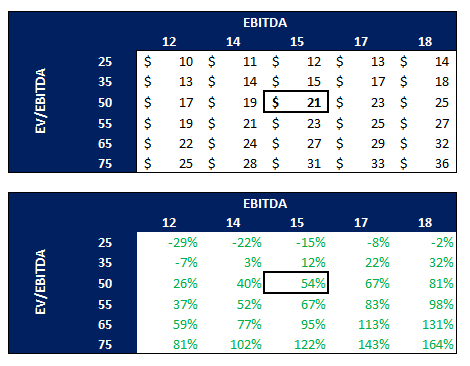

Vital Farms is well positioned to continue delivering durable compounded growth in Q4 22’ and beyond. The business has a strong track record of exceeding management’s guidance and consensus estimates, which is driven by solid sequential moment and management’s conservatism. This is a major positive for the business- a management team that under promises and over delivers. Importantly, Vital Farms’ strong position in the egg market enable the business to capture increasing share of the massive egg TAM. While eggs are regarding as a consumer staple, Vital Farms is driving growth on par with technology or discretionary products. This is driven by the business’ premium offering that aligns with the rapidly shifting consumer taste that favors specialty egg products. The trend towards specialty food products is visible in virtually every major food types- meats, beverages, snacks, etc.

Vital Farms is positioned to continue monetizing the megatrend of health conscious consumers, which is only picking up steam as younger generations gain more spending power. In the near term, Vital Farms is positioned to gain share from increased distribution, shelf space, SKU counts, farmer supply agreements, and average selling prices. The business is also driving awareness from marketing campaigns, which drives recognition while shopping. Vital Farms still has significant runway in each growth driver- doors, shelf space, SKU count, and farmer network. The launch of Egg Central Station 2.0 has secured the capacity to double revenues before additional capacity is needed. This provides high confidence that Vital Farms can drive sustained high growth as plenty of opportunity remains in reach.

The business is well positioned to continue driving operating leverage after navigating the massive spike in costs beginning in 2H 21. While the business is unlikely to drive as much leverage in Q4 as the previous Pragmatic forecast implied, the business is still positioned to drive immense growth in profits that far exceeds revenue growth. Importantly, the business has a clear line to sustained operating leverage in 23’ as input costs continue normalizing and economies of scale from Egg Central Station is achieved. The massive TAM, disruptive product, and proven business model translates to a high valuable business, which is not reflected in the market cap of the company. While Vital Farms’ stock has demonstrated strong resilience in 22’ as investors clearly have found a price floor for the stock, it is still far from reasonable levels given the business’ profit trajectory. As a result, the stock is poised to materially increase as investor demand for this unique disruptor turns positive.