Toast

Q3 22’ SUMMARY

Toast delivered revenue and earnings in Q3 that outperformed management’s guidance and consensus estimates. This outperformance was driven by Toast’s continued execution on the business’ powerful flywheel. In Q3, revenues were driven by monetizing spending at new and existing restaurants as well as upselling SaaS products.

Toast’s performance was largely impacted by the continued strength in the restaurant industry, which was the result of persistent consumer demand for out of home dining. This is another strong testament to Toast’s ability to position itself between restaurants and consumers. This is a highly valuable market position as it places Toast directly in the pathway of the massive consumer spending.

Toast continues to take share from legacy POS providers driven by the business’ product suite designed for the unique needs of restaurants. The business continued to drive strong momentum from restaurants seeking Toast out as word of mouth continued to be positive within the restaurant community. Overall, Toast has a long growth trajectory ahead as the TAM continues expanding and Toast continues developing solutions that address the unique needs of restaurants.

“Toast delivered strong results in the third quarter, surpassing $100 billion in annualized GPV for the first time and driving sustained revenue momentum and continued margin improvement. We continue to balance efficiency with disciplined investments in innovation to power the restaurant industry. ”

Key Takeaways from Q3 22’

Key Takeaway 1- FinTech Solutions Business Remains Strong

Restaurants using the Toast platform materially increased as the business continues gaining share in the massive restaurant industry.

Gross payment value (GPV) continued to grow driven by spending at new and existing locations.

Key Takeaway 2- Software Solutions (SaaS) Momentum Accelerated

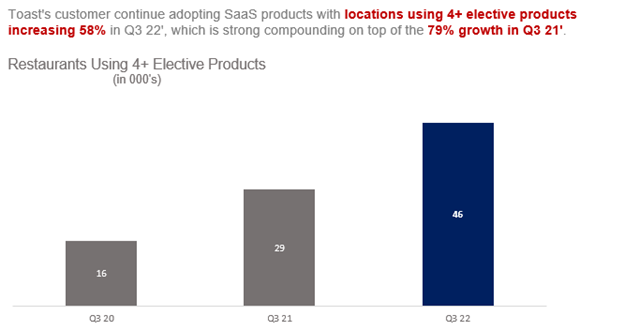

Toast leveraged its unique position inside restaurants to upsell SaaS products to help restaurants navigate a highly dynamic environment characterized by record demand and tight labor conditions.

Toast’s SaaS products were increasingly adopted by new and existing customers, especially driven by xtraChef, the acquisition of Sling, and Invoicing.

Key Takeaway 3- Restaurant Spending in the U.S. Remains Robust

Restaurant spending remained strong in Q3 22’ as consumers return to outdoor activities now that the pandemic is behind us.

Market research firms forecast sustained momentum through 22’ and the next several years.

GROWTH TRENDS

growth Factor 1- Financial technology solutions

Toast’s core FTS business is the main growth engine of the company’s business model. This service is the intro to Toast’s platform- the company offers well-designed POS systems that are made for restaurants, which can only be used if the restaurant uses Toast as their payment processing provider. This positions Toast between the restaurant and its customers, which enables the business to capitalize on consumers eating out at restaurants as Toast earns a percentage of every dollar the restaurant receives through the Toast system. In Q3, Toast continued to take share from legacy vendors as restaurants are increasingly gravitating towards solutions designed for restaurants. Toast saw gains from increased transactions as well as average order value.

The strong FTS growth was largely driven by continued momentum in GPV as the massive return to restaurant eating continued in Q3 22’. This substantiated the company’s claim that there was no observable pullback in consumer spending at Toast restaurants.

GPV increase was partially driven by a 42% increase in restaurants using Toast.

GPV increase was also driven by 7% growth in spending at existing Toast Restaurants.

Momentum in the FTS business was also driven by a strong increase in restaurants using the Toast platform. This expansion is a critical aspect of Toast’s business model, which is based on penetrating the massive restaurant industry that consists of over 860k locations in the US.

Restaurant growth was driven by new customers, existing customers, and newly launched restaurants.

QSR locations represented half of Toast’s bookings in Q3 22’ even though the QSR solution was only introduced earlier in 22’.

Toast has a win rate greater than 50% when being considered head-to-head with competitors.

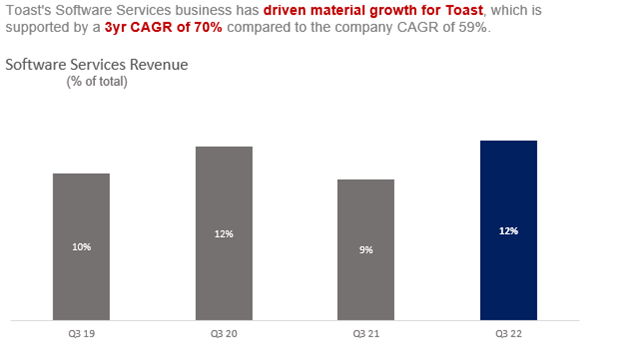

growth Factor 2- Software services (SAAS PRODUCTS)

Toast’s software business continues to see strong adoption as the business offers restaurants solutions to improve outcomes for operators, customers, and employees. Toast’s SaaS product suite is designed to address problems across the entire restaurant ecosystem. This includes solutions in the front of the house that are consumer facing as well as solutions in the back of the house that are operationally focused. The company continues to capture share from legacy vendors due in large part to Toast’s full product suite, which offers customers a fully integrated system of solutions.

Toast’s strong software services solutions revenue was driven by several factors in Q3 22’.

xtraCHEF drove momentum as the app now has a mid-teen adoption rate.

Payroll drove momentum with increasing adoption.

Toast’s upsell trends continue improving with 22’ adoption rates even stronger than 21’.

Adoption rates were driven by Toast’s recently launched e-commerce channel as well as the growth team.

Toast launched Invoice app based on research that indicated that restaurants have 7 operating models on average (brings B2B spending to Toast’s platform).

Source: Toast Presentation

Source: Toast Presentation

growth Factor 3- hardware and professional services

Toast’s actual hardware continues to serve a critical role for the business despite a declining importance from a revenue perspective. In Q3 22’, combined hardware and professional services revenues represented just 5% of total revenues. Toast does not seek to make money from the hardware sales as the POS terminals are more tools to get in the door rather than money making machines. This is the bedrock of Toast’s business model as the hardware is purpose-built for restaurants and designed to seamlessly interface with Toast’s software suite of products. Additionally, the professional services business is an ancillary line of business designed to serve as an additional support to restaurants.

OPERATIONAL EFFICIENCIES

Toast’s operational efficiency continued to outperform guidance and expectations. The business was more efficient than the Pragmatic forecast as well. This was driven by the company spending less on COGS and OpEx than expected as the business invests in the next stage of growth. The market responded negatively in Q1 22’ to management’s decision to return to negative profitability in order to build the foundation for continued growth. The company has demonstrated the ability to drive growth without allowing expenses to get out of control. Importantly, Toast is still in much better shape than pre-COVID as the scale has helped absorb many fixed expenses. Overall, Toast is well positioned to return to profitability for the long-term in late 23’.

INDUSTRY TRENDS

Toast’s business model positions the company to capitalize on the strong spending in the restaurant industry, which is expected to persist for the foreseeable future. Additionally, spending on delivery services is expected to remain strong, which drives higher margins for Toast as the economics for Card Not Present transactions are more favorable for Toast.

Specifically, spending at restaurants increased 11% in Q3 22’, which is strong given that growth in the year has been materially strong despite negative sentiment and inflation. Consumer spending continues to increase driven by high employment levels as well as demand for outdoor activities.

In 22’, market research firm Mintel expects restaurant spending growth of 5%, which is on par with pre-pandemic levels. Going forward, Mintel expects spending to generate a 5yr CAGR of 4% through 26’. Additionally, market research firm eMarketer expects restaurant delivery intermediary sales to increase 11% in 22’. Going forward, the research firm is forecasting a 5yr CAGR of 11% through 26’.

FORECAST AND VALUATION

Toast’s outperformance in Q3 provided additional support that the business is on a clear path to scale. While the business is likely to generate about -$70mm less revenue in Q4 than the prior Pragmatic forecast, management’s efficiencies position the business to deliver better EBITDA than previously projected. The key driver of the lower revenue projection is the balance of full year revenues generated in each quarter. As the year has progressed, it is becoming clear that trends in 1H 22 were stronger than expected relative to trends in 2H 22.

Toast’s business has a strong flywheel that creates momentum, which is showing no signs of slowing. The business continued acquiring new restaurant locations at even faster rates, which positions the company to capture even greater shares of the massive restaurant spending. Additionally, Toast is positioned to continue generating strong growth as the business successfully upsells the growing portfolio of SaaS products to an expanding base of restaurants. Importantly, Toast’s growing base makes the brand even more attractive to restaurants as word of mouth drives a material portion of the business’ acquisitions.

While the market continues to discount the company’s stock, investors eagerly demand the stock after earnings like those reported in Q3. Although the stock gives back much of the gains, this is driven by negative macro sentiment rather than Toast’s performance. Importantly, the stock is poised to rapidly recover from 22’ declines as the sentiment shifts positive in 23’ and Toast continues delivering results that strengthen the bull case. As a result, the valuation is poised for a major reset as current valuation is severely below averages since Toast’s IPO.