Toast

Q2 22’ SUMMARY

The post-pandemic restaurant spending boom has helped Toast continue to deliver strong results in Q2 22’. Toast’s strength was driven by impressive execution of the business’ go-to-market strategy designed to expand the growing restaurant base and upsell SaaS products to existing customers.

Overall, Toast continues to capture share within a large TAM as the business offers real solutions that enable businesses to increase revenues from customers and retention of employees. Toast helps restaurants run the business day-to-day, maximize customer value, manage complex workloads, and compete for top talent.

Source: Toast

Source: Toast Presentation

“Toast had another great quarter, sustaining our operating momentum with a record number of net new locations and strong revenue growth, both of which highlight the power of our industry leading digital platform for restaurants. ”

Key Takeaways from Q2 22’

Key Takeaway 1- FinTech Solutions Business Remains Strong

Restaurants using the Toast platform materially increased as the business continues gaining share in the massive restaurant industry.

Gross payment value (GPV) continued to spike with sharp increases in transaction value at both new locations and existing locations.

Key Takeaway 2- Software Solutions (SaaS) Momentum Accelerated

Toast leveraged their unique position inside restaurants to upsell SaaS products to help restaurants navigate a highly dynamic environment consisting of record demand and tight labor conditions.

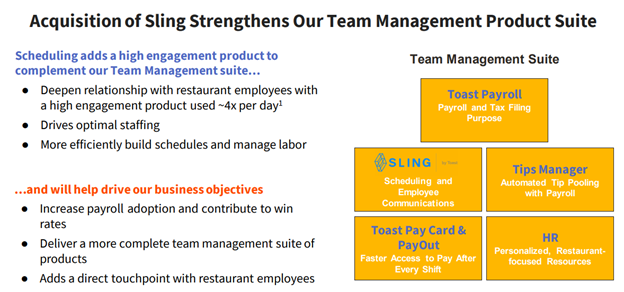

Toast’s SaaS products were increasingly adopted by new and existing customers, especially driven by xtraChef and the acquisition of Sling.

Key Takeaway 3- Restaurant Spending in the U.S. Remains Robust

Restaurant spending accelerated in Q2 22’ as consumers return to outdoor activities now that the pandemic is behind us.

Market research firms forecast sustained momentum through 22’ and the next several years.

GROWTH TRENDS

growth Factor 1- Financial technology solutions

Toast’s core FTS business is the main growth engine of the company’s business model. This service is the intro to Toast’s platform- the company offers well-designed POS systems that are made for restaurants, which can only be used if the restaurant uses Toast as their payment processing provider. This positions Toast between the restaurant and its customers, which enables the business to capitalize on consumers eating out at restaurants as Toast earns a percentage of every dollar the restaurant receives through the Toast system.

Source: Toast

Source: Toast

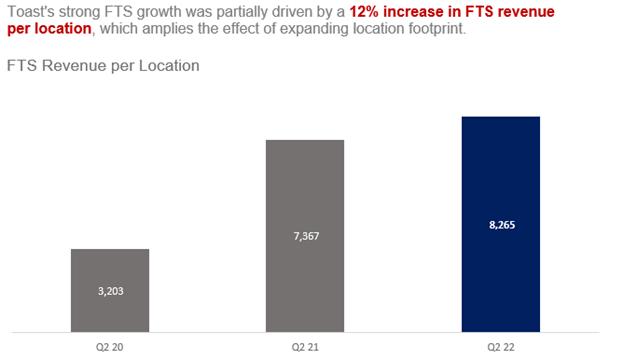

The strong FTS growth was largely driven by continued momentum in GPV as the massive return to restaurant eating continued in Q2 22’. This substantiated the company’s claim that there was no observable pullback in consumer spending at Toast restaurants.

GPV increase was partially driven by a 42% increase in restaurants using Toast.

GPV increase was also driven by 14% growth in spending at existing Toast Restaurants.

Source: Toast

Source: Toast

Momentum in the FTS business was also driven by a strong increase in restaurants using the Toast platform. This expansion is a critical aspect of Toast’s business model, which is based on penetrating the massive restaurant industry that consists of over 860k locations in the US.

Toast’s ability to scale the restaurant base was driven by Toast’s strong sales team building a pipeline of new business.

Toast also has a low churn driven by the high levels of customer satisfaction.

Toast saw demand from QSR’s and FSR’s as both restaurant types realize significant benefits from the Toast platform.

Toast saw sign-ups from a high rate referrals, which are driven by an increasingly dense footprint.

Source: Toast

Source: Toast

growth Factor 2- Software services (SAAS PRODUCTS)

Toast’s software business continues to see strong adoption as the business offers restaurants solutions to improve outcomes for operators, customers, and employees. Toast’s SaaS product suite is designed to address problems across the entire restaurant ecosystem. This includes solutions in the front of the house that are consumer facing as well as solutions in the back of the house that are operationally focused.

Source: Toast

Source: Toast

Source: Toast Presentation

Toast’s strong software services solutions revenue was driven by several factors in Q2 22’.

xtraCHEF was called out as a driver of business as it helps restaurants address labor shortages.

Strategic acquisition of Sling, which was previously a partner provider that demonstrated ability to lift win rates.

Expanding location base that Toast has been able to upsell at a rate even stronger than existing locations.

Friction removal from the rollout of Toast Shop combined with a dedicated sales team.

Source: Toast

Source: Toast Presentation

growth Factor 3- hardware and professional services

Toast’s actual hardware continues to serve a critical role for the business despite a declining importance from a revenue perspective. In Q2 22’, combined hardware and professional services revenues represented just 5% of total revenues. Toast does not seek to make money from the hardware sales as the POS terminals are more tools to get in the door rather than money making machines. This is the bedrock of Toast’s business model as the hardware is purpose-built for restaurants and designed to seamlessly interface with Toast’s software suite of products. Additionally, the professional services business is an ancillary line of business designed to serve as an additional support to restaurants.

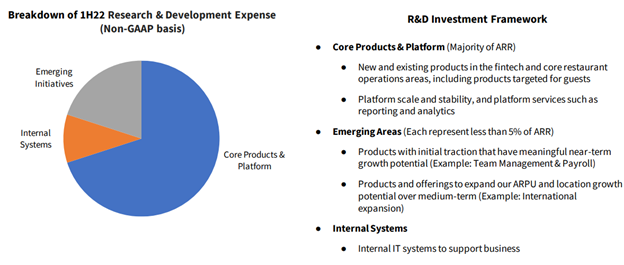

OPERATIONAL EFFICIENCIES

Toast’s efficiency was better than expected in this significant investment year. In Q2 22’, the business delivered efficiency that was well above initial guidance in early Q1 22’. Toast has demonstrated growth at scale with margins that are well below pre-COVID levels; however, management strategically decided to make 22’ an investment year to position the business for sustained momentum over the next several years.

Source: Toast Presentation

Source: Toast

Source: Toast Presentation

Source: Toast Presentation

INDUSTRY TRENDS

Toast’s business model positions the company to capitalize on the strong spending in the restaurant industry, which is expected to persist for the foreseeable future. Additionally, spending on delivery services is expected to remain strong, which drives higher margins for Toast as the economics for Card Not Present transactions are more favorable for Toast.

Specifically, spending at restaurants increased 14% in Q2 22’, which is material compounding on top of the 71% growth in Q2 21’. While this is a deceleration from the 24% growth in Q1 22’, the growth in this period is on top of a more modest 5% growth in Q1 21’.

In 22’, market research firm Mintel expects restaurant spending growth of 5%, which is on par with pre-pandemic levels. Going forward, Mintel expects spending to generate a 5yr CAGR of 4% through 26’. Additionally, market research firm eMarketer expects restaurant delivery intermediary sales to increase 11% in 22’. Going forward, the research firm is forecasting a 5yr CAGR of 11% through 26’.

FORECAST AND VALUATION

Toast is positioned to continue monetizing restaurant spend and taking share from legacy payment processing players. Guidance in Q2 22’ appeared conservative as the business is likely to drive growth north of 65% in 22’. Consumer spending in restaurants is showing no signs of slowing, which only makes the TAM larger. Toast’s business model positions the company to capitalize of the size of the industry. Additionally, Toast is driving tech adoption in the restaurant industry, which has been underserved compared to other industries.

Toast is positioned to drive operating efficiencies in 2H 22’ and 23’ now that most of the OpEx investments have occurred. The topline growth and improving efficiency positions Toast to generate meaningful operating leverage in 23’. These developments position the stock to realize material price increases as the negative macro sentiment has caused valuation to materially compress. As sentiment normalizes, Toast’s stock is primed to surge as it has yet to be rewarded for the significant growth that has occurred in the business.

Source: Internal Model

Source: Internal Model

Source: Internal Model