The Children’s Place

Q3 22’ SUMMARY

In Q3, The Children’s Place delivered revenues that were below prior year levels; however, these results exceeded management’s guidance and consensus estimates as the business’ marketing and product strategies were more effective than expected. The company delivered earnings that were below guidance and estimates as the business absorbed supply chain expenses that were considerably more than anticipated. The stock still increased on these results likely driven by the appreciation of the business’ fundamentally stronger growth trajectory post-2022 and efficient cost structure.

The Children’s Place had several positive developments in the quarter that demonstrate the business’ revitalized go-to-market strategy. The digital initiatives are the main area of progress as the business had generated impressive traction on the TCP app as well as the website. The collaborations with celebrity influencers have also driven significant engagement with the brand.

While the business has generated less revenue in Q3, this is largely the result of immense base effects from the extremely positive conditions in Q3 21’ driven by stimulus, pent-up demand from school openings, and general wardrobe refreshes. The underlying position that the business has established positions it for strong growth in 23’ once the base effects reverse into a tailwind. Lastly, the immense efficiencies created by the massive reduction in overhead from store closures position the business to generate outsized profit growth from here.

“Our Q3 sales were slightly stronger than our projections. August top line represented approximately 39% of the quarter. Digital represented 50% of our retail sales in Q3 versus 48% in 2021 and 37% in 2019. E-commerce traffic held up well during the quarter at positive 6% versus last year.

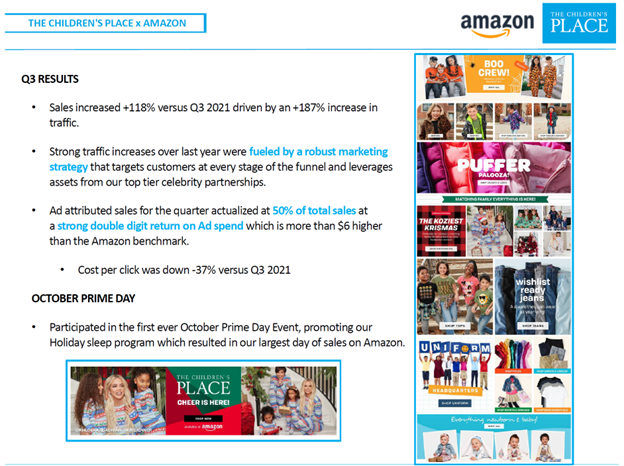

We delivered another strong quarter with Amazon, with sales up 118% versus Q3 2021. Our results were driven by a 187% increase in traffic versus Q3 2021, which was fueled by a robust marketing strategy that targets customers at every stage of the marketing funnel and leverages our top tier celebrity partnerships.”

Key Takeaways from Q3 22’

Key Takeaway 1- digital strength

Industry leading e-commerce penetration rates.

Significantly higher AOV and frequency on digital channel vs physical.

Strong digital marketing traction driving digital user expansion.

Key Takeaway 2- brick and mortar optimization

Continued reduction in footprint, which has been cut by over -30% since pandemic started.

Vast majority of store footprint is in the “off-mall” channel, which has superior economics and interest than the mall channel.

Strong store productivity of remaining locations despite material amount of customers shopping both channels.

Key Takeaway 3- massive childrens apparel tam

Spending remained strong despite significant price cuts across the industry, which helped fuel unit growth.

Spending patterns likely to normalize in 23’ after three years of abnormal consumer activities.

Market research firms continue to project that the apparel industry’s 4yr CAGR through 26’ will outpace the 4yr CAGR through 21’.

GROWTH TRENDS

growth Factor 1- digital business scaling

The Children’s Place has had significant success scaling the digital store to levels that far exceed the industry average. This had made the business a leader in establishing a robust omni-channel presence. The business has benefited from making strategic decisions even before the pandemic center on shifting a material portion of activity to the digital channel. These were difficult decisions as it meant that the business would be closing a material portion of its store base, which created a substantial sales headwind from the lost revenues associated with closed locations. This also meant that the business had to invest considerable resources into the digital platform and fulfilment capabilities in order to drive and meet demand in the digital channel.

This has proven to be a great decision as the business has generated material growth from the digital channel. This includes impressive results from the mobile app as well as the website as leadership has devoted substantial resources to optimizing the mobile app and website to drive adoption, usage, and average order value. The digital channel has experienced significantly higher order values and purchase frequencies than the physical channel. Given that the vast majority of customers are millennial Moms, the digital channel has directly aligned with this digitally oriented segment of the population. This has materially improved the advertising ROI of the business as digital ads are much more effective at driving digital commerce than it is for physical.

Digital traffic increased 6%, which is on top of massive spike in traffic in the base period.

Digital channel represented 60% of the business’ new customer acquisitions in Q3.

Digital has become half of the business in Q3, which further cements The Children’s Place as a leading omni-channel player.

Millennial Moms spend 75% more time shopping online and spend 66% more online than non-parent millennials.

Millennial Moms spend 8hrs per day consuming media, which makes them great targets for digital marketing.

Double digit ROI on ad spend driven by effective targeting and celebrity campaigns.

Mobile users spend 11% per purchase and shop 14% more frequently than non-mobile users.

Organic ads and influencer campaigns drove over 17bln digital impressions in Q3 22’.

growth Factor 2- physical footprint optimization

The Children’s Place has been executing on a massive go-to-market strategy evolution that is based on drastically reducing store footprint. While this comes with revenue growth headwinds from lost sales, it massively reduces the operational overhead as physical sales carry a much higher cost structure than digital. In Q3, the business continued to shed stores, which is now cutting deep into the store footprint due to compounding. The business is now positioned in primarily off-mall locations, which carry much better economics and align with where the consumer is moving when they do shop in-person.

The physical business drove all of the revenue contraction in the quarter, which was partially driven by a -6% reduction in stores compared to Q3 21’. This means that the industry-wide pricing pressures had a greater impact on the physical business than the digital business. Even still, average sales per store was greater than pre-pandemic levels despite traffic being down over -20% as a massive proportion of consumers have shifted to digital shopping. The Children’s Place expects to close an additional 40-50 stores in 23’ as over 75% of the store base will be facing a lease renewal event in the next 24 months.

growth Factor 3- market cross currents

The Children’s Place has experienced mixed results across geographies in the US as well as the new market of Amazon. The business reports international sales and Amazon sales in the “International and Other” category so results must be analyzed together. In Q3, the business saw outperformance in the Southern market, which is the largest region for the business. This is in contrast to weakness in all other markets, which is partially driven by base effects. These market are also more competitive for the business as the brand is not as strong as it is in the South.

This geographic weakness was offset by strong growth in the International and Other segment driven by strong results in the scaling Amazon business. The Children’s Place is taking the Amazon opportunity seriously with a new head of Marketing and Amazon role being created. The business has been investing considerable resources to ensure that the Amazon business has adequate inventory and marketing to drive growth. This signals a major new channel for the business that aligns with the core customer group that is likely a heavy Amazon user. This enables these Millennial moms to shop for themselves and their children on the same platform.

Prime in October was the largest single sales day for the business.

Amazon sales increased 118% driven by a traffic increase of 187%, which offset order value reductions.

Marketing has been a major driver of traction on Amazon with ads being attributed to 50% of sales on the platform.

Cost per Click (CPC) was down over -30% as the business has gotten more efficient with ad targeting in Q3.

OPERATIONAL EFFICIENCIES

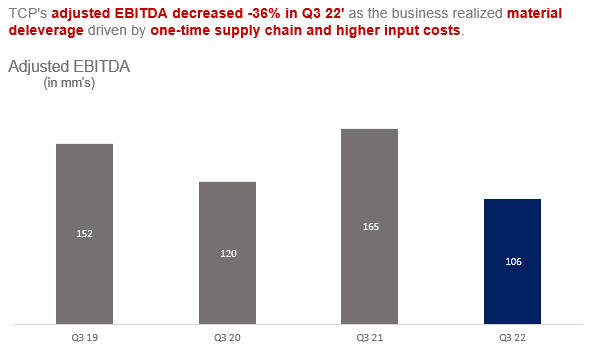

After drastically improving the business’ cost structure during the pandemic by cutting store count about a third, The Children’s Place experienced material margin compression in Q3. This reversal was driven by operating inefficiencies that were the result of base effects combined with effects of a highly promotional environment. In the prior year period, the business was able to avoid the massive logistic cost increases as a result of healthy inventory levels. Given that the business’ primary products are essential children’s clothing, the inventory does not have the same seasonal risk as typical apparel. While the business suffered delayed revenues from schools being in hybrid modes in 20’ and 21’, The Children’s Place benefited from having adequate inventory on hand when the supply chain disruption occurred. As a result, margins in Q3 21’ were not affected by the massive spike in logistics costs; however, the business faced materially higher expenses in Q3 22’ as it was the first time that massive amounts of inventory was purchased. Although prices are much lower in 22’ than they were in 21’, they are still above the rates the business paid in 19’ and 20’.

The business’ margins were also affected by an inventory management misstep. Not only did the business have higher logistics costs than prior year, a greater amount of inventory was purchased in anticipation of a normal sales season in Q3. This turned out to be a bad decision as the competitive environment was very promotional as competitors had to rid themselves of excess inventory. This caused the business to lose share as the company actually raised prices while others were cutting. This led to operating deleverage as fixed cost coverage was lower than it would have been if the share erosion did not occur. Additionally, the business faced higher input costs from elevated cotton prices. The higher average unit revenue did offset the higher average unit cost so the affects of higher cotton prices were not dilutive. Importantly, the business’ cost structure is still as strong as it was in 21’ due to the massive store closures combined with significant increase in digital sales. As a result, the profitability will bounce back as the elevated expenses in 2H 22 come and go.

INDUSTRY TRENDS

Demand for clothing remained strong in Q3 as consumers continued spending on clothing. This strength continued in the most recently available data through December 22’, which indicates that spending at clothing and clothing accessories stores continued growing in Q4. This is particularly indicative of an enduring trend as consumers had already spent so much on apparel in 21’ and 1H 22’ as many people needed to refresh their wardrobes after the pandemic eased, which led to sharp increases in outdoor activities. While many firms are communicating that they are observing demand moderation, the aggregate data indicates that consumer demand for apparel remains strong. Also, there are many firms that had more inventory than demand support so price cuts were reported across many national and global firms that sell apparel products.

Going forward, market research firms are still forecasting growth through 26’ that exceed the pre-pandemic rate. This reflects a shift in consumer demand for apparel post-pandemic. While it is impossible to identify the drivers with certainty, the increased outdoor activities likely plays a part in increased demand for apparel as these products are complementary to traveling, dining out, and participating in events. It appears that the pandemic has fundamentally shifted demand for socializing, which has the domino effect of shifting demand for apparel products to go along with the socializing.

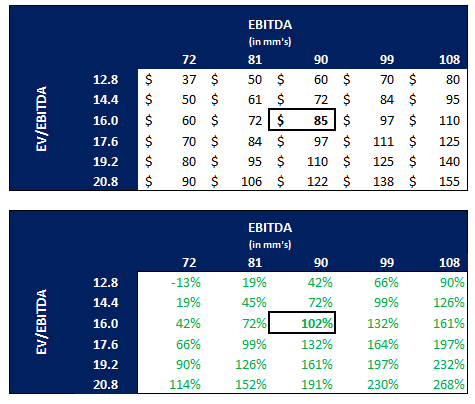

FORECAST AND VALUATION

The Children’s Place is positioned to continue managing through the growth challenges created by the combination of significant base effects from the strong 21’ as well as headwinds arising from price cuts across the industry. The business had a very strong year in 21’ despite operating with a massively reduced store footprint, which creates a substantial base effect. While revenue in 21’ exceeded pre-pandemic levels, a material portion of these sales were the result of revenues not following a typical uniform path. Many parents pushed back shopping during 20’ as children were engaged in virtual school. In 21’, many parents purchased much more than normal in part due to full wardrobe refreshes, which means that some sales in 21’ were the result of purchases being delayed. In fact, the 3yr CAGR in each quarter from Q1 21’-Q3 22’ was only positive in the two quarters that stimulus was given. This volatility smoothing metric indicates that the underlying business is generating a consistent level of growth over a three year period.

While the slightly negative growth appears as a negative development, it is important to take into account that the business closed over 33% of stores since the start of the pandemic. These lost revenue sources have had a massive impact on monetization potential, however strength in digital business has largely overshadowed the affects of such a massive reduction in store footprint. In Q4, the business is likely to experienced another period of moderate contraction from Q4 21’ due to base effects and volatility in the industry as many players have engaged in deep discounting to sell through excess inventory across their entire product categories. These factors are having a significant affect as management has opted out of price reductions as significant work has been done to raise average unit revenues after years of selling below the potential price level of the brand.

The business is likely to experience continued sharp profit declines due to temporary spikes in expenses. The business’ avoidance of inflationary pressure in 21’ due to solid inventory levels has positioned the company to replenish at costs that were much higher than they were last year. Additionally, the business engaged in significant inefficient shipping options to ensure adequate inventory levels in 2H 22’. As a result of the price cuts across the industry and higher than necessary inventory levels, the business will be engaging in price reduction to keep pace with the competition. This will drive margins down in Q4 as the business works through the inventory deemed to be in excess of necessary levels. While this means that the business’ significant operating leverage largely created by materially cutting the expensive store footprint has reversed, the business is still structurally positioned to drive material levels of profitability after the elevated expense activities pass.

The stock is trading at a steep discount even with the temporary reduction in profitability in 22’, which positions the stock for a massive increase in value in 23’. This is likely to occur as the business demonstrated revenue growth in 23’ combined with operating leverage that drives outsized profit growth. Additionally, the stock has been responding very well to the shifting market conditions, which is likely being affected by changes in the massive short interest. At current valuation levels, the stock can easily double yet still be valued at relatively moderate levels.