PayPal

Q3 22’ SUMMARY

PayPal delivered revenue and earnings that materially outperformed management’s guidance and consensus estimates. Additionally, the business’ revenue was inline with Pragmatic estimates while the earnings were much higher than the Pragmatic forecast. This performance as driven by continued execution of the business’ compelling model resulting in continued share gains in the massive payments industry.

PayPal’s growth was driven by strong user acquisition, platform usage, and spending increases. The business continues to demonstrate the ability to capture meaningful portions of global consumer spending. While there were headwinds in the international business, PayPal’s domestic business more than offset the weakness abroad.

Overall, PayPal has a unique position in a massive market with an expanding TAM. The business continues to develop and launch innovations that attract new users while stimulating increased spending from existing users. PayPal is a great example of leveraging market positioning to integrate innovations that drive durable compounding growth.

“We delivered strong third quarter results. We will continue to invest against our key priorities to advance our leading position in digital payments and commerce. We’re very pleased to be working with Apple to enhance our offerings for our PayPal and Venmo merchants and consumers.”

Key Takeaways from Q3 22’

Key Takeaway 1- Paypal’s platform continues gaining scale

Active accounts increased materially in Q3 22’ with strength across consumer and merchant accounts even at record levels of scale.

Engagement on the platform outpaced account growth as PayPal is acquiring greater numbers of users who are engaging more and more on the platform.

Key Takeaway 2- the business drove growth across portoflio

PayPal’s core transaction revenues increased materially in Q3 22’ as the business monetizes digital commerce.

PayPal’s secondary Other Value Added Services revenues continued to grow at a moderated pace, which is being driven by the business’ capitalization on the Buy-Now-Pay-Later trend.

Key Takeaway 3- consumer spending is strong even post-pandemic

E-commerce spending continued to demonstrate strong momentum in Q3 22’ even after the massive adoption during the pandemic.

Globally, e-commerce is expected to continue taking share from brick and mortar retail, which is expected to continue growing as well.

GROWTH TRENDS

growth Factor 1- balanced global momentum

While PayPal has a large global business, the domestic business is core to the company especially in the last couple of years. In Q3 22’, the domestic business drove the company’s growth as the international business continued to face headwinds that emerged in 2H 21’. This divergent performance was not enough to derail the business’ growth as the domestic business is materially larger and generated growth that more than compensated for the temporary international headwinds.

The international business is still a material contributing force to PayPal’s growth in recent periods. In Q3 22’, the international business generated accelerated growth from Q3 21’ levels as this business started to recover from sharp headwinds in recent periods. Trends abroad were positively impacted by a return to spending growth after headwinds related to longtail pandemic impacts as well as volatility related to geopolitical tensions. Both of these forces had a reduced impact in Q3; however, the business still has ways to go before it is back on track. This is a tailwind for the business in 23’ as there is no evidence that the international business will not continue returning to strong growth that is inline with the domestic business. In fact, it could easily be stronger given PayPal’s position in cross border transactions and the larger international TAM.

growth Factor 2- robust platform monetization

PayPal’s platform monetization drove momentum in the core transactions business. PayPal’s business model places the business in a central role in the digital commerce megatrend. The platform enables buyers and sellers to digitally transact with each other in a seamless manner. PayPal has massive scale, which is a product of the company’s first mover advantage. The business is designed to monetize digital commerce by way of charging transaction fees to buyers and sellers that commercially engage with each other using PayPal’s proven technology.

Venmo, Braintree, and e-commerce were cited as drivers of transaction revenue growth in Q3 22’.

PayPal experienced negative headwinds from eBay and PayPal’s broken relationship, which has had the effect of reducing headline revenues.

Excluding fees from eBay, total revenue would have increased 13% instead of the 11% reported for Q3 22’.

The transactions business is fundamentally driven by active accounts and activity (spend) per active account, which both increased in Q3 22’.

While the Value Added Services business is not nearly as important to the business as transaction services, it is still a meaningful contributor to PayPal’s growth and profitability. The company has integrated services outside of core payments into the business model, which is a wise move given PayPal’s proximity to consumers and businesses. The business continued to rebound from the massive blow dealt by COVID in Q2 20’.

PayPal’s partnership with Synchrony Bank is cited as driving strong growth for Buy-Now-Pay-Later services.

PayPal’s BNPL offering has wider reach than any other player due to PayPal’s existing proximity to businesses and consumers who engage in e-commerce.

PayPal’s BNPL platform includes over 25mm customers who have used the service over 150mm times.

growth Factor 3- Platform engagement growth

PayPal’s payment platform generated strong results driven by increased scale and spending. PayPal continues to defy limits by compounding at scale despite the business’ decades long tenure. The platform demonstrated strength across virtually every metric outside of average transaction size; however, this was more than offset by growth in users and growth in average number of transactions. This drove material spending growth per active account in the quarter, which translates to revenue for the business. Overall, PayPal’s strength is driven by the platform’s over 8x greater presence compared to peers. This makes consumers 2x as likely to purchase on a given site due to the trust consumers have for the widely known brand.

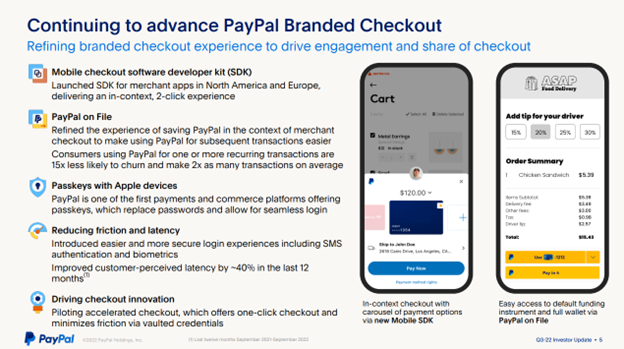

In the quarter, PayPal continued to rollout initiatives to drive spending from existing customers while attracting new customers. Management is focused on introducing innovation to elevate the experience, integrate value added technologies, and checkout solutions. All of which are designed to reduce friction, which is one of the key drivers of growth for platform businesses like Amazon. Ease of purchase is known to drive transaction growth. Importantly, the business has managed to continue growing spend on the platform even after a massive growth in spending during the pandemic. While it is still early days, PayPal continued to make inroads towards increasing spend from offline transactions, which represents a massive opportunity as contactless payment spending activity increases.

Braintree spending increased over 38% in the quarter.

Tap pay with Apple wallet will be launched soon.

PayPal branded sites increased share of spend in the US.

Enabled merchants to provide in-app checkout functionality.

Enabled one-click checkout.

Launched PayPal rewards to incentivize increased spending.

OPERATIONAL EFFICIENCIES

In Q3 22’, PayPal’s efficiency continued to be a headwind driven by temporary factors as well as structural ones. The business faced headwinds from the lost eBay revenues, which came with higher margins. The business also faced headwinds related to lower margins from Braintree transactions, which continued to materially scale in Q3 22’. PayPal has initiated the massive cost cutting program aimed at driving leverage by removing redundancies in the PayPal, Braintree, and Venmo systems. As a result, inefficiency was not as strong in Q3 as it was in 1H 22’. Going forward, the business is positioned to drive material operating efficiencies in Q4 22’ followed by greater efficiency gains in 23’.

Specifically, the business will be cutting over $800bln in expenses from the recurring cost structure in FY 22’ followed by over $1.2bln in additional expense reductions in 23’. While this is a clear indication that the business was operating with immense inefficiencies in prior year, recent investors will be able to enjoy the new PayPal. Additionally, the business has engaged in a massive share repurchase program, which makes the business even more profitable on an earnings per share basis.

INDUSTRY TRENDS

PayPal’s business model and scale uniquely positions the business to capitalize on the growing e-commerce megatrend. PayPal is deeply entrenched in the digital payments industry based on the platform’s connection with hundreds of millions of economic participants. In other word, e-commerce’s gain is PayPal’s gain.

Specifically, e-commerce spending in the U.S. increased 11% in Q3 22’, which is on top of 10% growth in Q3 21’. In Q3 22’, e-commerce spend represented 15% of retail spending in the US, which is on par with the 15% representation in Q3 21’. This is especially positive as 20’ and 21’ were strong years for e-commerce spending given the COVID impact on brick and mortar spending.

In 22’, market research firm eMarketer expects e-commerce spending in the US to increase 9% in 22’ after a strong period of growth in 20’ and 21’. Looking out into the medium term, the firm is projecting e-commerce spending to grow at a 5yr CAGR of 11% for the five year period ending 26’, which has reduced by 1ppt since the last update driven by conservatism and strength in brick and mortar trends. This compounded growth is expected to outpace that of brick and mortar spending, which is expected to drive e-commerce as a percentage of total from 15% in 21’ to 20% in 26’.

In 22’, eMarketer expects global e-commerce spending to increase 10% after a strong period of growth in 20’ and 21’. Looking out into the medium term, the firm is projecting e-commerce spending to grow at a 5yr CAGR of 9% for the five year period ending 26’. This compounded growth is expected to outpace that of brick and mortar spending, which is expected to drive e-commerce as a percentage of total from 19% in 21’ to 24% in 26’.

The Buy-Now-Pay-Later trend is expected to continue growing from a user base and payment value perspective. This financing option has truly taken hold in the economy, which bodes well for business’ that contribute to the infrastructure of this novel and classic form of financing. In 22’, eMarket expects BNPL users to grow 56% to reach 79mm in the US. This is a massive increase from the 102% growth in 21’ as more and more consumers adopt BNPL, which is being facilitated by merchants offering the financing type. These users are expected to spend $76bln using BNPL, which is a staggering 77% increase from the $43bln BNPL spend in 21’.

Looking ahead to the medium term, eMarket is projecting users and payment value to grow at a 5yr CAGR of 16% and 27%, respectively. This implies that BNPL users will represent about 40% of internet users in the US, which is a material expansion from the 20% in 21’. Financially, this implies that BNPL will represent about 11% of all e-commerce spend by 26’, which is more than 2x the 5% representation in 21’.

FORECAST AND VALUATION

PayPal is well positioned to continue taking share in the massive global payment processing industry driven by continued strength in e-commerce spending. While there has been much negative sentiment, the consumer continues to demonstrate immense spending power in spite of inflation. PayPal is uniquely positioned in the retail industry as the business is largely agnostic to product segment trends as PayPal makes money from spending in general. The business is not reliant on any product type over another so cross currents driven by shifting consumer behavior does not affect the aggregate spending.

While PayPal has immense scale, the business still has significant addressable market as every consumer engaging in digital payments is a potential customer. The business’ growth potential is evident in the numerous engagement and monetization metrics that clearly indicate a smooth growth path. PayPal’s recently launched innovations around platform ease and experience are likely to drive adoption and spend as the business designed these innovations to address user friction points. Additionally, the business is also positioned to realize share gains from handling payments occurring offline due to the company’s inroads in the contactless payment space.

PayPal is positioned to generate margin expansion for the first time since 21’ as the business laps several headwinds, which helps to fully display the massive cost cutting the business has completed in 22’. Management has done a great job working with activist investors to operate in a much more productive manner by cutting waste and identifying efficient ways to “get the job done”. Importantly, the results of the efficiencies will drive material earnings growth in 23’, which supports a valuation reset in 23’. The stock has been a victim of circumstance in 22’ due to the negative sentiment that took hold of the market in 22’. Importantly, the business has only improved the top and bottom line trajectory, which supports a much higher stock price driven by earnings and valuation growth.