OneWater Marine

Q3 22’ SUMMARY

OneWater delivered strong results in Q3 that barely missed management’s guidance and consensus estimates driven entirely by Hurricane Ian in Florida, which reduced revenues by -$25mm and diluted EPS by -$.17/sh. Even still, the business delivered growth at a significantly accelerated rate and earnings that imply continued record profitability.

OneWater’s performance was driven by continued execution of the business’ unique go-to-market strategy. The business model is based on bringing consolidation to the highly fragmented and lucrative boating industry. OneWater successfully integrated recently acquired dealerships, which led to increased revenues and profits as these acquisitions have been highly accretive.

The business continued to drive monetization driven by the immense demand for boats that has created record backlog, which has driven prices to record levels. Overall, OneWater has plenty of growth ahead as the business continues taking share of the massive boating industry that is dominated by inefficient local dealerships.

“Our team executed flawlessly despite challenges spurred on by a constrained supply chain and strong consumer demand throughout the year. Our robust acquisition cadence, coupled with our focus on diversifying our business to expand our finance and insurance, and parts and service revenue, has established a proven model that continues to outperform the industry. Recently, we have seen a strong start to the boat show season, reinforcing the healthy demand environment.”

Key Takeaways from Q3 22’

Key Takeaway 1- balanced growth across segments

Continued momentum in the new boat business despite material supply constraints.

Strong rebound in pre-owned boat business despite scarce supply of willing sellers.

Massive service, maintenance, and parts momentum driven by successful integration of acquired business.

Highly profitable financing and insurance business kept pace with the overall business.

Key Takeaway 2- strong growth from new and existing locations

Massive revenue growth from dealerships acquired over the last twelve months.

Strong same store sales growth driven by favorable pricing and cross-selling.

Key Takeaway 3- continued boat spending momentum

Boating activity continues to persist at levels above pre-COVID as consumer interest in outdoor activities has continued.

Massive supply constraints support record prices across the industry.

Market research firms forecast sustained momentum through 22’ and the next several years.

GROWTH TRENDS

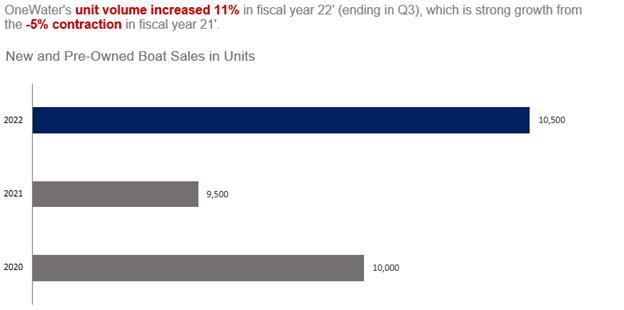

growth Factor 1- core new and pre-owned boat businesses

OneWater’s core business of selling new and pre-owned boats continued to drive growth in Q3 driven by strong underlying demand and higher prices. The business is a market leader in majority of the geographic regions served as the industry is dominated by smaller independent dealerships. This size proved to be a major advantage in the current environment as it enabled OneWater to take share from having greater availability of high price boats. While the industry is dominated by boats that are smaller than 30ft, consumer demand for larger boats has been unparalleled. These boats have stronger demand and weaker supply, which supports sustained record prices for these products.

OneWater drove growth in new and pre-owned boats in part by the business having greater availability as the entire fleet is available for every store. This means that a dealership can offer customers boats that may be in another state whereas smaller competitors are unable to access such broad inventory. Given that OneWater carries over 70 brands, it is highly likely that a customer would want a boat that is not carried in a small dealership. This massive choice helped OneWater further differentiate itself from the competition, which is exactly the objective of the business.

Demand was robust and steady throughout the quarter.

Revenue was driven by an increase in units and average selling price.

OneWater is the largest customer of the top 5 boat brands, which gives the business standing above small dealerships.

Pre-order book was strong going into Q4 as demand remains elevated.

OneWater’s proprietary inventory management system was a competitive advantage as it enabled the business to operate much more nimbly than small dealerships.

Inventory is still very tight with 11wks-12wks of supply compared to 20wks-22wks in Q3 19’.

OEM’s are expected to start lowering prices as boats become available; however the premium segment of large boats is largely insulated given demand and much longer manufacturing cycle that drives low supply.

growth Factor 2- store footprint optimization

OneWater drove immense growth from successful integration of acquired dealerships between Q3 21’ and Q3 22’. While it appears that OneWater is simply paying for growth, the business’ acquisition strategy is highly sophisticated. It is designed by leveraging management’s multi-decade experience in the unique boating industry. The targets are not random dealerships with owners that are willing to sell. The targets are dealerships that have massive value locked up by the small scale of the dealership. The small scale leads to inefficiencies and massive opportunity costs that a larger organization can bring to fruition. OneWater’s tailored strategy has led to a long pipeline of acquisition opportunities; however, management is careful to not overextend the business with too many acquisitions over a given time period.

The massive growth in sales per store compared to pre-pandemic levels is a testament that OneWater can acquire and scale dealerships. Specifically, the strategy is based on brining OneWater’s leading fleet to local dealerships through the business’ ERP system, cross-selling services that are not offered at local dealerships, and recognizing cost synergies from shared back office functions. OneWater keeps the existing management team in place as the boating industry is based on long standing relationships with predominantly family owned business. OneWater focused on everything but selling activities, which the existing management team has already demonstrated the ability to build a book of customers.

The industry consists of over 4,200 dealerships, which means OneWater has a vast runway of growth.

OneWater only focuses on dealerships with economics that make a doubling of EBITDA in a compressed timeframe possible.

Acquired 4 dealership brands in fiscal 22’, which ended September 30.

growth Factor 3- revenue diversification strength

OneWater’s secondary businesses continued to scale in Q3 as the business is seeking to gain market share by footprint expansion and wallet share gains. This is a highly ambitious plan as OneWater is simultaneously scaling multiple business without skipping a beat. Specifically, OneWater is seeking to expand wallet share by cross selling services, maintenance, and parts services to existing boat customers. Given that boat ownership has a high level of recurring expenses to keep the boats operational, this is a logical extension for OneWater. This is the reason that the company acquired a business focused on these services instead of spending all available capital on dealerships exclusively. Not only does this drive revenue growth, it also drives margin expansion as the service business has much higher margins than the boat business. The business now generated a material amount of revenues from non-boat products. As OneWater continues to scale, the business is well positioned to drive growth of secondary business by simply cross selling services.

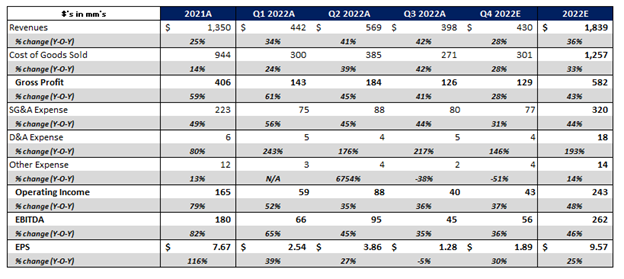

OPERATIONAL EFFICIENCIES

OneWater continued to deliver profitability well above pre-COVID levels driven by several accretive factors. The business is driving considerable operating leverage from scaling revenues above expenses. Gross margins have materially expanded driven by significant increases in realized prices and a material increase in revenue from high margin businesses. The immense demand for boats, OneWater’s push into the large boat market segment, and record shortages have driven immense growth in average selling price. While some input costs have increased, the price increases more than offset the elevated costs.

Additionally, OneWater has successfully integrated the service, maintenance, and parts business, which drove material growth in profitability. Overall, the operational efficiency is a direct result of OneWater’s business model, which is based on acquiring independent dealerships at attractive multiples, integrating the new dealerships into OneWater’s efficient system, and cross selling products at the new dealerships. This effective approach enables the business to achieve the ambitious goal of doubling EBITDA within 24 months of acquisition.

INDUSTRY TRENDS

The boating industry is experiencing material growth from secular behavioral changes that have materially increased demand. Additionally, the industry is facing sharp supply constraints as OEM’s are unable to produce boats at a rate that keeps up with demand. This is partially driven by the supply chain disruptions during 20’ and 21’, which materially impacted boat manufacturing given the significant number of parts needed to build a boat.

These dynamics have driven prices of boats to record levels while inventory remains well below pre-COVID levels. According to management, average industry inventory was 22wks in 19’ and the average industry inventory is ~ 16wks, which is substantial improvement from levels in early 22’. The trends for large boats (over 40ft) are even stronger than smaller boats (under 30ft) as underlying demand has increased for these larger boats and OEM’s are having a harder time making these larger boats. As a result, market research firm Euromonitor is forecasting continued strength in 23’ after material growth in 20’-22’.

FORECAST AND VALUATION

OneWater is well positioned to continue driving strong growth in Q4 22’ driven by growth across the organization. Similar to recent periods, this growth will be driven by acquisitions and same store sales growth. The business has a proven M&A strategy designed to purchase dealerships that could greatly benefit from OneWater’s infrastructure, premium boat access, and service offerings. Additionally, OneWater’s immense average selling price growth makes the store footprint much more valuable from a monetization perspective. While the backlog remains at record levels, OneWater’s operationally efficiency enables the business to maximize revenues during this period of constrained supply. This is actually a competitive advantage as many unorganized and small competitors are unable to optimize flow of inventory, which is driving business to OneWater.

The business’ strong performance in Q3 was largely inline with the Pragmatic forecast; however, the hurricane in Florida certainly suppressed some of the demand that would have been realized in Q3. The business is supported by a strong secular backdrop that is highly unlikely to fade anytime soon as demand remains well above supply. Given that OEM’s are unable to manufacture adequate supply to meet this demand until 24’, OneWater has a clear path to continued growth. Additionally, the business has material tailwinds from the unique business model that positions the company to take share away from largely independent dealers that lack scale.

OneWater’s operational efficiency and diversification with high margin line of businesses positions the company to drive strong EBITDA growth. This trend will persist as the services, maintenance, and parts business continues gaining traction from OneWater’s cross-selling tactical strategy. Additionally, the high margin financing and insurance business is likely to gain additional traction as new locations start offering customers these services. Overall, the business momentum has made the stock much more valuable as profits have increased materially. The negative sentiment in the market has made valuation levels highly unsustainable. Additionally, the stock’s low volume and market cap have likely contributed to the disconnect between the business and the stock. In 23’, the stock is well positioned to materially increase as the business delivers continued topline and bottom line strength.