Magnite

Q3 22’ SUMMARY

In Q3 22’, Magnite delivered revenue and earnings growth that outpaced guidance and consensus estimates. While the business delivered results that were slightly below the Pragmatic forecast, this was driven by factors outside of the business’ control. The advertising industry faced material headwinds in the quarter as the average advertiser paused a portion of their budget until more confidence in the macro was gained. This led to a decline in CPM’s, which is akin to a decline in price for a good. As a result, the average player providing advertising services faced headwinds.

In Magnite’s case, the turbulence was handled phenomenally well as the business has a strong position in the CTV space, which was much more resilient than the broader advertising industry. Additionally, advertisers may have paused portions of their overall budgets, but they also diverted more spending towards higher ROI methods such as programmatic. This positioning helped Magnite gain material share in the advertising market, which is a great set up for 23’ as more CTV inventory comes online and the DV+ business fully rebounds.

“We delivered strong results in Q3, with total revenue ex-TAC and CTV revenue ex-TAC exceeding our guidance for the quarter. Adjusted EBITDA also grew nicely and delivered a margin of 35% for the quarter. We were able to show improvement in Q3 growth rates in CTV and DV+ as compared to Q2, despite challenging macro conditions. We continue to build upon and scale our CTV capabilities to better serve new and existing customers and believe we are well positioned to grow revenue in 2023.”

Key Takeaways from Q3 22’

Key Takeaway 1- ctv ad spend continues trend of rapid growth

Advertisers are increasingly allocating budget to CTV inventory as they must “follow the eyes”.

Magnite continued to increase CTV inventory, which is still well below demand for this premium advertising format.

Key Takeaway 2- global spend on platform remains robust

Growth was balanced as the international business recovered from 1H22 headwinds, which drove outperformance versus the domestic business.

DV+ trends remained challenged; however, mobile spending continued to display green shoots signaling a corner is being turned in this important side of Magnite’s business.

Key Takeaway 3- Digital advertising spend continues to grow

Despite significant negative talk about the economy, consumer spending remains high so advertisers are heavily incentivized to continue ad spend to reach consumers.

Industry level CTV inventory continues to rapidly increase as consumers switch to CTV and CTV providers offer AVOD (ad supported CTV), which drives more advertisers into the market thus supporting robust growth.

GROWTH TRENDS

growth Factor 1- Geographic Balance

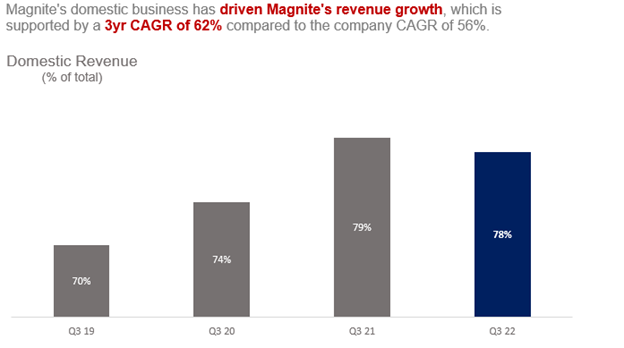

Magnite’s geographic balance in Q3 was inline with balance in Q1 and Q2 as the business continued to drive growth domestically and abroad. In Q3, the domestic business drove 66% of Magnite’s revenue growth despite representing 78% of Magnite’s revenue. The international business outperformed the domestic business, which resulted in this business driving 34% of Magnite’s revenue growth despite representing 22% of Magnite’s revenue. While the international business continued to grow at a faster rate than the domestic business, this is the result of base effects as the international business’ growth was from a smaller base in 21’.

The key driver of strength in the domestic business is the more advanced development of the CTV advertising industry relative to the international business. This is driven by domestic consumers adopting streaming faster than their international counterparts as domestic streaming platforms addressed the US demand first. As a result, the CTV market is not as developed as the development lag has created a monetization lag. This means that the international business is driven by DV+ trends more than the domestic business. Similar to prior periods, the DV+ market is facing significant CPM compression due to macro pressures domestically and internationally. As a result, the international is disproportionately impacted by the DV+ trends.

Additionally, the international market was impacted by FX headwinds driven by the strong US dollar. Overall, both markets were positively impacted by record ad impressions, which offset the CPM pressure experienced globally. Going forward, the international market is well positioned for strong growth as CTV infrastructure continues to be developed. The domestic market is also positioned for continued dominance due to this market being the central location of most of Magnite’s key CTV partnerships. Lastly, both markets will benefit from improvements in DV+ growth in 23’ after the volatility in 22’.

growth Factor 2- Connected tv (ctv)

Magnite continued benefiting from secular shifts into ad supported (AVOD) CTV consumption. Magnite’s programmatic platform is perfectly aligned for CTV as programmatic is the only functional way to buy/sell ads in a digital environment. Magnite’s leadership on the sell side of the programmatic industry positions the company well to extend dominance into the CTV segment of the industry. In Q3 22’, Magnite’s CTV business was driven by new partnerships as well as expanded partnerships. The business continues to benefit from new publishers entering the space, which drives budget reallocation from linear TV. Magnite is positioned to drive growth in the future as streaming activity continues to outpace linear.

Expanded partnership with Fox consisting of Magnite being Fox’s SSP partner, which includes Fox’s entertainment, sports, and news inventory.

Magnite’s SSP and ad insertion combo led Vizio to select Magnite as an SSP along with adopting Magnite’s “Tiles on Home Screen” product that monetizes the home screen of CTV consumers.

Deal with Kroger to integrate the retailers rich and massive first party data, which helps advertisers target and measure in a much more powerful way.

Deal with LG Ads as the company’s preferred SSP, which enables Magnite to access LG’s first party data to personalize ad inventory.

Disney partnership is scaling as the company monetizes more of its premium content.

Netflix inventory is expected to add considerable value to the platform as it scales.

Magnite’s CTV platform will be substantially upgraded in December 22’, which should drive spending on the platform.

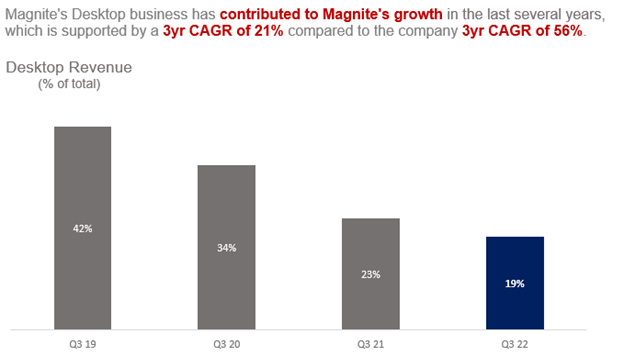

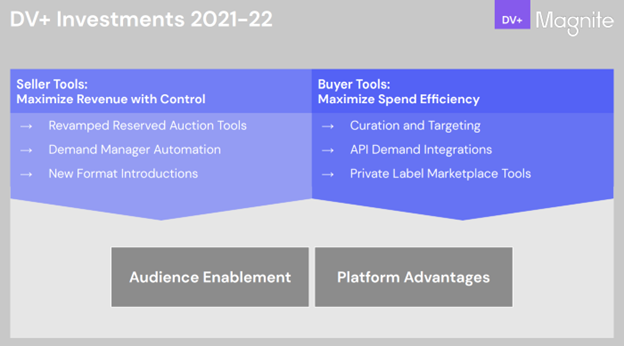

growth Factor 3- DV+ (Mobile and desktop)

The DV+ business represents roughly half of Magnite’s revenues, which is materially lower than historical levels as the CTV business is gaining scale. This is due to organic and inorganic growth as Magnite strategically acquired pureplay CTV tech firms to accelerate the business’ CTV-native capabilities. In Q3’, the DV+ business continued to experience headwinds as the macro factors directly impacted this business. Additionally, it appears that management’s focus on scaling CTV led to a diversion of attention on the DV+ products. This seems to have led to under investing in the products, which is problematic as continuous innovation is needed to keep the platform aligned with evolving customer needs.

In Q3, management shared that trends in the DV+ business had recovered from a take rate perspective; however, the macro factors led to CPM’s compressing. As a result, spending decreased despite the number of ads sold increasing. The silver lining is the fact that ads sold increased, which means that the price adjusted demand was higher in Q3 22’ than Q3 21’. This means that the DV+ product changes have had an effect on advertiser interest. Going forward, management is expecting a return to growth as over 30 projects are executed with the intent of making the platform more powerful for advertisers. This will primarily come in the form of enhanced targeting and measurement functionality.

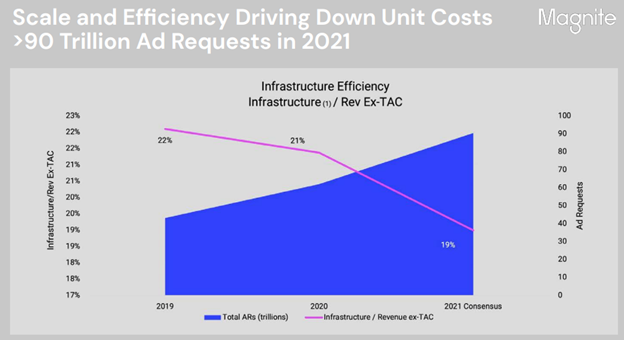

OPERATIONAL EFFICIENCIES

Magnite continued to deliver immense profitability relative to the company’s historic margin profile. The operating efficiency was driven by scale as well as significant synergies realized post-acquisitions. In Q3 22’, Magnite was able to maintain record Q3 profitability levels despite headwinds in the market, especially in the DV+ segment. Management shared that margins outperformed guided levels due to lower expense than expected, which was the case across many areas of the business. Interestingly, Magnite could have easily increased marketing spend or reduce take rates to drive momentum, but did not have to do so given the strong secular tailwinds for CTV advertising. Going forward, the business is positioned to drive margin expansion as CPM’s increase faster than expenses.

INDUSTRY TRENDS

While the digital advertising industry has been receiving significant negative press in recent times, the underlying market remains intact. This is largely driven by megatrends that transcend negative sentiment and uncertainty. The fact is that business have integrated advertising into their business models, which means that they need to continue advertising in order to drive traffic and sales. If businesses could simply grow without advertising then they would have done so many years ago. Interestingly, competition for consumer’s dollar incentivizes businesses to continue advertising to attain mindshare above the competition.

Advertisers are certainly becoming more selective with their spending as they are focused on identifying advertising with a measurable ROI. This means that some players will win share at the expense of others that lack demonstrable ROI advantages. Companies are continuing their hiring, consumers are continue their spending, and digital activity continues compounding. Additionally, spend on CTV is expected to materially outpace the other segments of the advertising industry. These are likely to drivers behind market research firm, eMarketer’s forecast for continued strong growth over the next several years on a domestic and global basis.

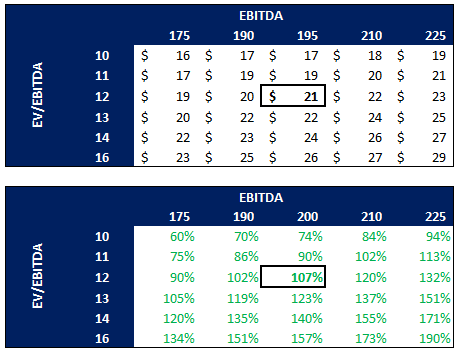

FORECAST AND VALUATION

Magnite’s strong performance in Q3 22’ sets the business up for a strong finish to 22’. The business has demonstrated a clear ability to take share in the advertising industry driven by Magnite’s strong flywheel. The company has evolved into a major player in the industry by positioning itself as the premier sell side platform (SSP). This has resulted in the platform having massive scale on the publisher and advertiser sides of the industry. Additionally, Magnite continues to drive momentum from integrations with leading players on the publishing, data provision, and advertising segments of the market. This positions the business to continue monetizing the megatrend that is CTV. Magnite’s continued work in the Mobile and Desktop segments of the industry serve as additional levers of growth in Q4 and beyond. Lastly, Magnite shared that political spending in Q4 doubled over the previous year, which will cause political ads to represent about 3 percentage points of Magnite’s business in Q4.

The business’ outperformance on the earnings side is another positive indicator for a strong EBITDA and EPS finish to 22’. Magnite continues to demonstrate the ability to efficiently scale the business, which is driving material margin expansion. Additionally, the company’s share repurchase program is benefiting shareholders as well as the operating efficiency. Management has shared that investments in the next stage of growth will make margins consistent with Q4 21’ instead of compressing margins. This is another strong piece of evidence that the business is ran by a management team that is not pursuing growth at all costs. In reality, a business that is able to drive growth and margin expansion is an indication of a management team that has clarity on what sets of activities drive growth as opposed to simply throwing money at the business.

The stock had a massive increase when the company reported Q3 results, which coincided with a strong CPI report. This has fundamentally shifted sentiment on the stock in addition to likely causing a short squeeze. While this is a welcome development, the stock is still trading at a materially discounted valuation based on historical levels. This does not even take into account the evolution in profitability that has occurred in recent periods. For this reason, Magnite’s stock poised for continued growth in 23’ as sentiment continues turning positive and the company delivers revenue and earnings that outperform expectations.