Magnite

Q2 22’ SUMMARY

Magnite’s revenue growth continued to compound in Q2 22’, which is a stark contrast to the stalled growth some digital advertising players are experiencing. The business’ continued scaling is being driven by Magnite’s unique position in the AdTech industry. Magnite is one of the largest SSP’s (sell side platforms) with several billions of dollars worth of ad spend processed on Magnite’s platform.

The business is essentially capturing opportunity created by two megatrends- advertising dollars shifting from traditional media to digital media and advertising dollars shifting from traditional TV to connected TV (CTV). Neither of these massive consumer behavioral changes show signs of slowing, which positions Magnite to continue building momentum.

“We once again delivered good results in Q2, with adjusted EBITDA growing 30% year-over-year, driven by strength in CTV. We continued to show that our diverse omni-channel go-to-market strategy, combined with our highly attractive and durable business model, is able to perform well in challenging macro conditions.”

Key Takeaways from Q2 22’

Key Takeaway 1- ctv ad spend continues trend of rapid growth

Advertisers are increasingly allocating budget to CTV inventory as they must “follow the eyes”.

Magnite has successfully acquired and integrated businesses with technological capabilities to extend Magnite’s leadership on the sale side of the AdTech industry.

Key Takeaway 2- global spend on platform remains robust

Growth was balanced in both the US and International businesses even with headwinds in EMEA and APAC

While CTV is driving the most growth, advertisers continued spending on DV+ (mobile and desktop) inventory despite a small pullback on desktop ad inventory spend.

Key Takeaway 3- Digital advertising spend continues to grow

Consumer spending remains high, which means advertisers are heavily incentivized to continue ad spend to reach consumers.

CTV inventory is rapidly increasing as consumers switch to CTV and CTV providers offer AVOD (ad supported CTV), which drives more advertisers into the market thus supporting robust growth.

GROWTH TRENDS

growth Factor 1- Geographic Balance

Magnite’s performance was strong across markets despite headwinds in EMEA and APAC. Management cited challenges in DV+ CPM’s (cost per impression) in EMEA as the geopolitical tensions, spike in energy costs, and rising rates caused advertisers to reduce spending budgets. The U.S. business demonstrated resilience relative to the international business as advertisers did not adjust their budgets as rapidly.

The U.S. business did not grow as rapidly as the international business due to base effects from stronger growth in Q2 20’ and Q2 21’.

The international business does not have the same CTV tailwinds as the U.S. given differences in the adoption rates in the markets.

growth Factor 2- Connected tv (ctv)

Magnite continued benefiting from secular shifts into ad supported (AVOD) CTV consumption. Magnite’s programmatic platform is perfectly aligned for CTV as programmatic is the only function way to buy/sell ads in a digital environment. Magnite’s leadership on the sell side of the programmatic industry positions the company well to extend dominance into the CTV segment of the industry.

CTV is insulated from the walled gardens like those that Google and Meta operate due to the CTV industry being far too fragmented for any one publisher to own a material piece of the pie.

CTV is driving the cord cutting trend, which is diverting billions of ad dollars into the space.

Magnite is integrated into the infrastructure of the CTV market from both an SSP and ad server capacity.

Magnite has a list of top-tier CTV publishers that make Magnite’s platform more valuable to advertisers, which ultimately makes the platform more valuable to publishers. The company highlighted additional deals closed in Q2 22’ with LG Ads and Scripps. These deals integrate data on consumer content consumption behavior and billions of monthly impressions for political ads this Fall. The business has also successfully integrated recently acquired companies, which has created even more value for the platform.

growth Factor 3- DV+ (Mobile and desktop)

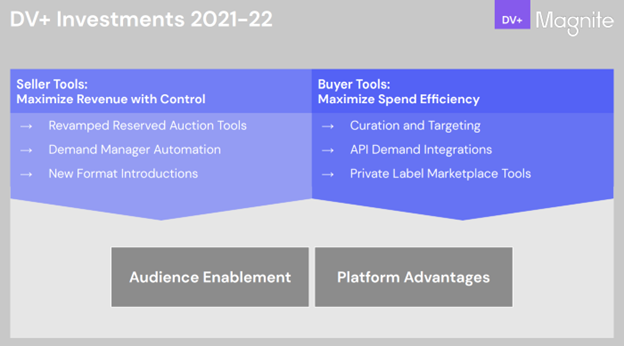

Magnite’s DV+ (Mobile and Desktop) business generated moderate growth despite material headwinds from advertiser budget cuts especially in EMEA and APAC. The DV+ business represents roughly half of Magnite’s revenues, which is materially lower than historical levels as the CTV business is gaining scale. This is due to organic and inorganic growth as Magnite strategically acquired pureplay CTV tech firms to accelerate the business’ CTV-native capabilities. The mobile and desktop formats were actually the only ad format types for the business prior to the strategic shift into the CTV market, which was a great move.

Growth has lagged the CTV market due to fundamentally different market dynamics. Simply put, mobile and desktop as an ad format are mature markets relative to CTV, which is nascent. Even still, these ad formats are integral to the digital advertising industry as they represent access to the vast majority of internet users, especially mobile. These markets usually do not have growth issues; however, the macro headwinds have created a rare dynamic.

Importantly, these headwinds are likely temporary given that they are based on caution rather than genuine market contraction from poor economics. Magnite is investing heavily in CPM enhancing features, which focus on identity and measurement. Additionally, the platform just gained access to a materially greater number of ad inventories, which has led to the platform handling 2x greater ad requests. The political ad spend should be an additional tailwind for these ad formats in 2H 22’.

OPERATIONAL EFFICIENCIES

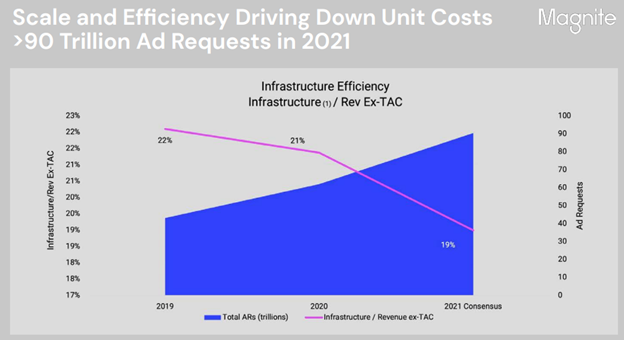

The business is much more profitable than historical levels due to Magnite executing on an efficient business model. While caution suppressed spending in some markets, the business continue driving accelerated efficiencies. Magnite called out considerable synergies from the acquisition of SpotX due to material cost savings from overlapping platform operating expenses. This was a sound business move as Magnite was able to drive revenue gains while generating operating leverage. Importantly, the business still has considerable leverage that will be unlocked as the platform continues scaling.

INDUSTRY TRENDS

While there have been headwinds in the digital advertising industry, market research firms are still projecting 22’ to be another strong year. This comes as no surprise given the role that digital advertising plays in the business models of countless companies. These firms can’t simply cut advertising spend yet expect to grow their own businesses. They need to spend to stay top of mind or else they risk market share loss to competitors who continued to spend on advertising. As the projections below indicate, digital ad spending is expected to continue growing, especially the segments that Magnite dominates on the sell side (Programmatic, Programmatic Display, Programmatic Video, and Programmatic CTV).

In 22’, market research firm eMarketer is projecting global digital advertising spend to increase 22% on top of the 29% increase in 21’. Going forward, the firm is projecting digital advertising spend to grow at a 5yr CAGR of 12% over the 5yr period ending 26’.

In 22’, eMarketer is projecting U.S. digital advertising spend to increase 18% on top of the 38% increase in 21’. Going forward, the firm is projecting digital advertising spend to grow at a 5yr CAGR of 11% over the 5yr period ending 26’.

In 22’, eMarketer is projecting U.S. programmatic display advertising spend to increase 22% on top of the 41% increase in 21’. The firm is projecting spend to increase an additional 17% in 23’ followed by 14% in 24’.

In 22’, eMarketer is projecting U.S. programmatic video advertising spend to increase 28% on top of the 48% increase in 21’. The firm is projecting spend to increase an additional 21% in 23’ followed by 15% in 24’.

In 22’, eMarketer is projecting U.S. programmatic CTV advertising spend to increase 39% on top of the 79% increase in 21’. The firm is projecting spend to increase an additional 22% in 23’ followed by 19% in 24’.

FORECAST AND VALUATION

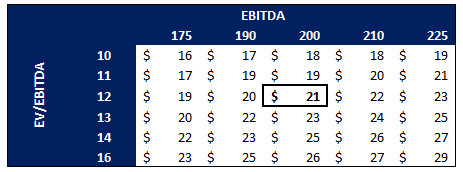

Magnite is well-positioned to continue scaling the business as the company captures share of an expanding TAM. The business is a major enabler of megatrends, which creates conditions that are highly favorable for the company. These megatrends are based on real consumer behavior, which does not shift often. Magnite is positioned in the infrastructure of the AdTech industry, which is the reason that world renowned publishers partner with Magnite. This massive ad inventory is highly attractive to advertisers who need to purchase the inventory to reach their end consumers. In other words, Magnite’s business model is based on a powerful flywheel. Additionally, the business has a significant amount of operating leverage, which means that profits should outgrow revenues for the foreseeable future.

Magnite’s stock has not been spared from the market’s intense negativity in 22’. This is especially true for stocks that reflect the technology industry. This has caused valuation multiples to plummet well below historical averages as investors simply have not wanted to own stocks, especially technology stocks. Importantly, this selloff is not based on substantive rationale. Magnite is in better shape than it has ever been, which will be rewarded when the time comes for investors to rebuild their portfolios.