Capri Holdings

Q3 22’ SUMMARY

Capri delivered strong revenue and earnings growth in Q3 22’ that exceeded management’s guidance and consensus’ estimates on both the top and bottom line. This outperformance was driven by Capri continuing to execute on the business’ compelling business model to capture share of strong consumer spending on luxury goods. The business’ performance was largely driven by strength in Americas with the Michael Kors brand outperforming the others. This is a stark contrast to previous periods in which Versace and Jimmy Choo easily outperformed the Kors brand due largely to the massive scale of the Kors brand. While the reported results are positive, there were immense FX headwinds that materially distorted to economic performance of the international businesses with immense affects on Versace and Jimmy Choo revenues.

Capri’s performance was consistent with the industry as consumer demand for luxury goods remains as strong as ever. Overall, Capri’s performance was driven by continued introduction of newness across the three brands along with effective monetization of Capri’s massive customer databases. The business realized particular strength from new product types that give Capri’s customer segment access to aspirational luxury for more products than handbags. The business continued to deliver great results on an efficiency front as profits increased at a faster rate than revenues driven by price increases, operational efficiencies, and channel mix shift. This is on a reported basis, which means that adjustments for FX headwinds would yield even stronger margin expansion. Overall, the global luxury market is massive and exhibiting strong signals of growing demand. Capri is well positioned to continue growing, especially as share is gained in non-core product segments.

“We are pleased with our second quarter performance as we delivered strong revenue growth and record earnings per share. Results were driven by momentum across all three of our luxury houses reflecting the power of Versace, Jimmy Choo and Michael Kors as well as the continued execution of our strategic initiatives”

Key Takeaways from Q3 22’

Key Takeaway 1- balanced brand growth

Michael Kors business demonstrated significant strength driven by new Signature products, company owned store mix, and higher prices.

Versace business reported strong growth, however FX adjusted growth was significantly higher as currency headwinds in EMEA and Asia distorted performance measurement.

Jimmy Choo reported moderate growth, however FX adjusted growth was significantly higher as currency headwinds in EMEA and Asia distorted performance measurement.

Key Takeaway 2- americas and emea momentum

The Americas business materially outperformed the other markets on a reported basis driven by momentum across each brand as well as a strong dollar.

The EMEA business moderately increased as FX headwinds largely distorted immense strength in Versace and Jimmy Choo businesses, which have a significant presence in EMEA.

The Asia business moderately contracted as FX headwinds distorted strength in each brand and China’s COVID lockdowns materially impacted demand in China.

Key Takeaway 3- MASSIVE digital advertising TAM

Market research firm Euromonitor is projecting strong growth in 22’ and beyond.

Consumer spending on luxury goods remains a bright spot in retail, which is holding up very well in the face of macro fears and inflation.

Spending is poised to drastically accelerate a China lockdowns have been eased post-protests in early December.

GROWTH TRENDS

growth Factor 1- michael kors strength

The Michael Kors brand represents Capri’s most significant business as it is the flagship brand for the company. While the Versace and Jimmy Choo brands are increasing in size, Michael Kors remains the core business for Capri. For this reason, trends within the Michael Kors business are critical to Capri’s overall health. Results in the quarter provide evidence that management has made significant progress turning this business around over the last several years despite the COVID disruption. As a reminder, the Michael Kors business was struggling after years of saturation and promotions that led to branding problems. This could be a fatal blow for a luxury brand as the business model is based on consumers perceiving the brand as luxury, which enables higher prices and foster strong loyalty.

In response, management split the business’ brands into two categories that are defined by price ranges and designs. The accessible luxury is branded as MICHAEL by Michael Kors and the luxury category is branded as the Michael Kors Collection. These brands have clearly distinct design differences so as to make consumers aware of the different brands. The company has also engaged in a store footprint optimization initiative that largely consisted of reducing wholesale (department store) distribution points, reducing and remodeling full price distribution points, and modestly increasing outlets (strategic channel to sell excess inventory). This was necessary as the luxury brand flywheel only turns when products are accessible for those who can afford it, but not so accessible that consumers “see the brand everywhere”. Additionally, reducing the wholesale distribution gives the business more control of pricing and product staging, which is tantamount to control of the brand.

In Q3 22’, the business outperformed Versace and Jimmy Choo on a reported currency basis. Even on an adjusted basis, which is more accurate, the Michael Kors business demonstrated strength relative to the high growth Versace and Jimmy Choo brands. Momentum in the quarter was driven new bags, shoes, and eyewear products. The Signature brand represented about 50% of Michael Kors’ revenue, which is a major accomplishment as many doubted the brands ability to get consumers to pay thousands of dollars for their bags again. The material penetration of the high priced Signature products has additional profit benefits as these products carry much higher margins than the Michael by Michael Kors products. While the business continued to experience headwinds in the wholesale channel from reducing distribution points as well as caution from retailers, the business is in great shape to drive durable growth.

Global customer database increase 17%, which has significant strategic benefits as it allows the business to leverage data analytics to effectively drive customers through the sales funnel.

Women’s accessories retail sales increased MSD, which indicates the non-core product lines are increasing in importance.

Footwear retail sales increased HSD, which is another important category to drive wallet share gains.

Men’s retail sales demonstrated strong DD growth as the business continues to attract a new customer into the flywheel.

growth Factor 2- versace continued scaling

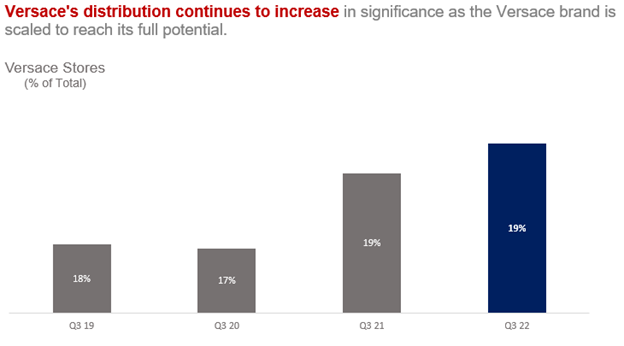

Versace added material value to Capri’s performance in Q3 22’ driven by continued scaling on the iconic brand. Capri has successfully integrated Versace into the business, which enabled the company to scale the brand into Americas and APAC in a more aggressive manner. The Versace business has undergone a similar footprint optimization strategy as Michael Kors with Capri focusing on limiting wholesale distribution in favor of company owned distribution. This has been a major success in that Versace continues to grow from a much smaller base of distribution points. While the wholesale channel will always be important for Versace, upgrading company-owned stores creates an immersive experience for consumers. This drives engagement and loyalty in addition to saving the brand from potential impairment driven by saturation.

In Q3 22’, performance was strong on a reported basis; however, adjusting for FX headwinds creates a much more accurate depiction of Versace’s momentum. While this was the case for Michael Kors, EMEA is Versace’s core business so the FX headwinds had a disproportionate affect on reported results for Versace. Versace’s momentum was driven by strong adoption of women’s accessories, women’s footwear, and men’s and women’s ready-to-wear products. This was all supported by continued storytelling through celebrity partnerships and high-profile fashion shows.

Versace’s global customer database increased 40%, which is a significant development as this database is used to directly market to customer thus lower customer acquisition costs.

Women’s retail accessories sales increased 60% as Versace’s non-core products continued to resonate with customers.

La Medusa, Virtuous, and La Greca product lines drove Versace’s growth.

growth Factor 3- jimmy choo continued scaling

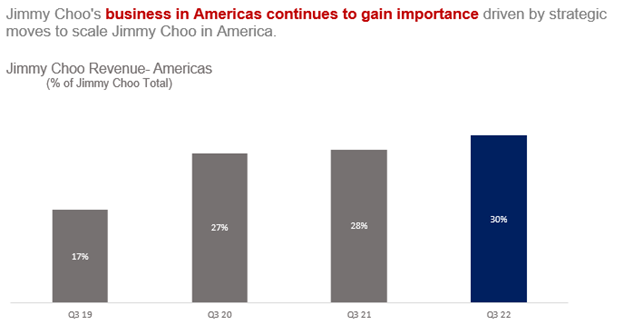

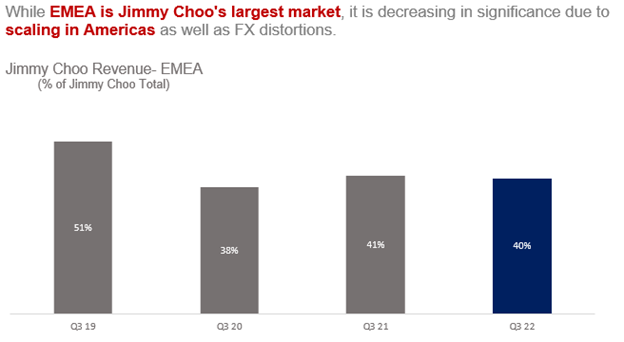

The Jimmy Choo business continued to perform well in Q3 22’, especially when taking into account the massive FX headwinds the brand faced. Similar to Versace, Jimmy Choo generates most of its business abroad as the business has non-US roots. Similar to Versace, Capri is focused on bringing Jimmy Choo to the US in full scale. In addition to scaling the business in APAC as it is underpenetrated.

The Jimmy Choo business is an emerging brand for Capri given the brands’ size relative to Michael Kors and Versace. Unlike these brands, Jimmy Choo’s roots are in high-end footwear whereas Michael Kors and Versace is rooted in leather products. Capri acquired the Jimmy choo brand to unlock the global potential of the brand by integrating it within the Capri business model. The company has significant relationships and mass marketing skills to be applied to the Jimmy Choo brand. The move has paid off as the Jimmy Choo business has generated strong compounding growth since the acquisition with the exception of the COVID impact on retail in FY 20’.

The Jimmy Choo business has generated strong growth from product newness, storytelling, data-intensive marketing, and broader distribution. Much of this growth has been generated in the APAC market, which is Jimmy Choo’s core market. Management has materially expanded the footprint the footprint in Asia to address this strong demand. Additionally, management has materially scaled back on the wholesale distribution of Jimmy Choo products in favor of company-owned distribution growth. Similar to Michael Kors and Versace, focusing on company-owned expansion increases control and branding of the business.

The global customer database increased 30% in Q3 22’, which has material benefits as Capri can leverage the massive database to drive conversion from engaged consumers.

Accessories sales increased 30%, which is a driver of growth for Jimmy Choo as majority of the business is in footwear.

The Veren and Bon Bon product lines launched newness in Q3 22’ that was well received.

Celebrity partnerships were cited as engagement drivers, especially with major influencers like Kendell Jenner.

Source: Capri

Source: Capri

OPERATIONAL EFFICIENCIES

Capri generated earnings growth that exceeded revenue growth due to the business’ operational efficiencies combined with accretive affects of price increases. Additionally, earnings growth was aided by Capri’s strong share buyback program, which lowered the share count meaningfully. While many retailers are facing margin pressures from elevated inventory, lingering freight cost inflation, and price reductions, Capri is in a far superior position due to the business’ standing in the global luxury industry. Being a luxury brand enables Capri to withstand pricing pressures as consumers are much less elastic to price for luxury brands. Interestingly, many luxury goods consumers prefer to pay prices that prohibit the masses being able to afford the products. The price becomes a pay wall thus creating and sustaining exclusivity.

Capri’s strategic decisions to limit wholesale distribution and resist the short-term temptation of being promotional to move inventory have returned the brand to luxury status. Not to mention the positive brand perception of Versace and Jimmy Choo, which did not have the dilution issues that Michael Kors was contending before the pandemic. While maintaining prices has caused Capri to give up some volume growth in a single period, it has led to stronger margins compared to Q3 21’ as well as Q3 19’. Lastly, the business’ cost structure improves with greater sales contribution from company-owned stores given the margin saved from cutting out the middle man.

INDUSTRY TAILWINDS

The global luxury goods market is experiencing strong growth in 22’ and market research firms are projecting trends to persist. This strength is partially driven by consumers continuing to rebuild wardrobes and collections post-pandemic. Consumer travel is also driving luxury goods spending in major destinations like New York, Miami, London, and Paris. While there is a large degree of fear in the market about inflation and recession, the luxury consumer is still spending on luxury goods as they live their lives as normal. Additionally, the top luxury brands continue to stimulate the market by introducing a constant stream of newness that creates strong consumer interest. As a result, Euromonitor is forecasting strong growth of 9% in 22’ on top of the immense 25% growth in 21’. The market research firm is projecting TAM to expand 11% in 23’ before normalizing to MSD growth over the next several years.

FORECAST AND VALUATION

While management is guiding a mid-single digit revenue contraction in Q4 22’, the business is highly likely to exceed this cautious forecast. This is due to seasonal relationships and present momentum supporting a stronger revenue performance in Q4. Additionally, management clearly communicated that the guidance was based on caution driven by several macro factors such as FX headwinds, China lockdowns, and wholesale uncertainty. A more reasonable assessment of conditions implies revenues coming in slightly above Q4 21’ levels. Importantly, this is on a reported basis, which does not take into account the substantial FX headwinds in Q4 22’ compared to Q4 21’.

Capri’s underlying business trends across the three brands support the assumption that momentum will continue in Q4 22’ and beyond. The business has entered Q4 with a much stronger customer database, which serves as a key driver of sales as the database presents the business with a high engaged audience to target with data analytics and compelling storytelling. Additionally, the business continues to introduce innovation to customers by way of compelling designs across several product types. The accessories business continues to be a growth driver for Capri’s brands along with deepening Versace and Jimmy Choo penetration in less developed markets and channels.

The business is positioned to continue mitigating the elevated cost environment by using higher prices to retain margin. This is a competitive advantage for luxury brands that are able to raise prices much more easily due to consumers being price inelastic, relatively speaking. In fact, higher price has strategic benefits as luxury consumers value brands whose products have higher prices that creates scarcity/exclusivity. Additionally, the massive database lowers customer acquisition costs as most marketing is targeted to consumers within the database rather than mass marketing channels, which are infinitely more expensive. This sets Capri up for strong earnings growth that exceeds revenue growth in Q4 22’ and beyond. The share repurchase program is an additional driver of EPS growth. This continued operating leverage positions Capri’s stock to materially improve as valuation is a fraction of normal levels, especially considering the much stronger margin profile compared to historical averages.