AMD

Q4 22’ SUMMARY

AMD generated strong revenue growth driven by momentum in data center CapEx, and increased end-consumer demand for devices embedded with semiconductors. AMD’s performance was offset by sharp inventory corrections across the PC market, continued softness in the PC gaming market, and base effects from the strong demand for new gaming consoles in Q4 21’.

AMD continued to gain significant market share as many competitors continued to suffer negative growth. AMD’s product position in the high-end of every market served insulated the business from headwinds in the data center, gaming, and embedded end-markets. Importantly, the business is already seeing improvements in the hardest hit areas while many competitors are still in the middle of the correction.

AMD’s business model continued to drive above-average results that led to share gains in every end market the business operates in, which is a powerful indicator of the business compelling product suite. The business’ product strategy of innovation delivered through regular product releases created tailwinds across several end-markets, especially the data center and embedded markets.

Overall, the semiconductor market has a massive TAM driven by perpetually increasing global demand across many sectors of the global economy. The data explosion created by the modern world creates a continuous need for semiconductors as data is unable to be created, stored, and transferred without semiconductors. This has created several megatrends including cloud computing, AI and ML-based applications, and immense video consumption.

The semiconductor industry’s demand will outlast the recent volatility created by post-COVID consumer behavior normalization and corresponding inventory corrections. Importantly, AMD is well-positioned to continue growing as 23’ plays out.

“2022 was a strong year for AMD as we delivered best-in-class growth and record revenue despite the weak PC environment in the second half of the year. We accelerated our data center momentum and closed our strategic acquisition of Xilinx, significantly diversifying our business and strengthening our financial model.

Although the demand environment is mixed, we are confident in our ability to gain market share in 2023 and deliver long-term growth based on our differentiated product portfolio”

Key Takeaways from Q4 22’

Key Takeaway 1- industry leading product roadmap

AMD drove demand from new products tailored to the data center market. This led to over 100% revenue growth in the hyperscale segment of the data center market.

Embedded revenues were driven by the addition of an entirely new business (Xilinx) combined with new products that apply AMD’s technology to Xilinx products.

New products in the PC gaming market position the business for growth in 23’.

Key Takeaway 2- PC AND GAMING END-MARKET VOLATILITY

Explosion of PC demand during pandemic (20’ and 21’) led OEM’s to chase demand via sharp supply increases. Demand pullback from elevated levels drove OEM’s to initiate massive inventory correction actions.

The PC gaming market also experienced a surge in demand during the pandemic. Normalization has led to lower demand relative to 21’ levels.

The semi-custom segment experienced negative base effects as strong console product cycle is sunsetting.

Key Takeaway 3- MASSIVE SEMICONDUCTOR TAM

Data center CapEx, gaming spend, and embedded devices are projected to expand in 23’ and beyond.

PC shipments are projected to pullback in 23’ followed by a return to growth in 24’.

Market research firms expect cross-currents to persist into 23’, which is expected to be characterized by high variability in growth between end-markets.

GROWTH TRENDS

growth Factor 1- scaling data center business

AMD’s data center business has been increasing in importance relative to the other markets AMD serves. This has resulted in the data center business driving a material portion of AMD’s total revenue growth. AMD’s high performance products are adopted by customers because the products help optimize performance and efficiency. The company’s products are helping AMD take share in the data center market as competitors have repeatedly failed to deliver innovation on a time scale customers demand.

AMD cited material strength in the hyperscale segment of the data center market as the global explosion of data has driven mass migration to cloud computing, which is supported by hyperscale data centers. This megatrend places enormous pressure on data centers to expand capacity to support the sharp increases in workloads. These data center operators must spend billions of dollars in CapEx to facilitate the expansion of capacity. AMD’s innovation has created a leading product roadmap that has given data center customers confidence in partnering with AMD over the long-term.

In Q4 22’, revenue from hyperscale data centers more than doubled compared to Q4 21’.

AMD new EPYC server processor products experienced continued workload and instance wins from several hyperscale data centers operated by Azure, AWS, and others.

AMD experienced weakness in the enterprise segment of the data center market as these customers reduced CapEx spend to see how the macro environment developed.

AMD secured wins across the enterprise market with particular strength in the Financial Services, Automotive, Technology, and Automotive end markets, which sets up a strong 23’.

The 4th gen EPYC processors have 2x the performance of competing products as well as 80% more efficiency than these products, which has positioned AMD to keep taking share.

More than 140 platforms will be using the 4th gen EPYC products in the enterprise segment.

growth Factor 2- accretive embedded acquisition

AMD’s embedded business has driven material growth for the company, which has offset headwinds in the PC and gaming businesses. The embedded business has enabled AMD to materially diversify end markets served effectively expanding AMD’s reach well-beyond core end-markets. AMD’s decision to scale their embedded business through acquiring Xilinx was a great strategic move as it positioned AMD to capture some of the immense demand across many end-markets that have integrated high-tech into their products. The product set ranges from Tesla cars to the Mars rover. The global demand for high-performance semiconductors in the embedded market adds considerable size to AM'D’s TAM.

AMD saw continued demand across sectors as there is broad utility for advanced semi products in numerous end markets.

AMD is preparing to introduce innovation in 23’ with IP that combines the powers of AMD and Xilinx, which positions the business to take greater share.

AMD’s premium technological design combined with legacy Xilinx products helped the business gain share in the embedded market in Q4 22’.

AMD has been able to realize revenue synergies from cross-selling products across AMD and Xilinx’s respective customer portfolios.

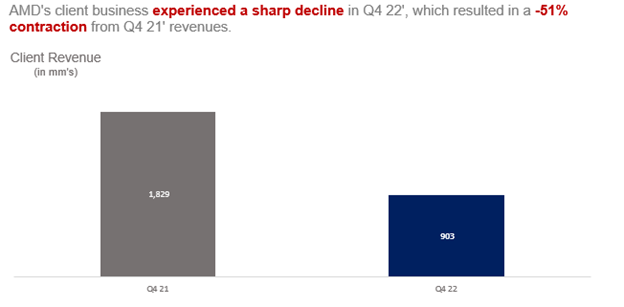

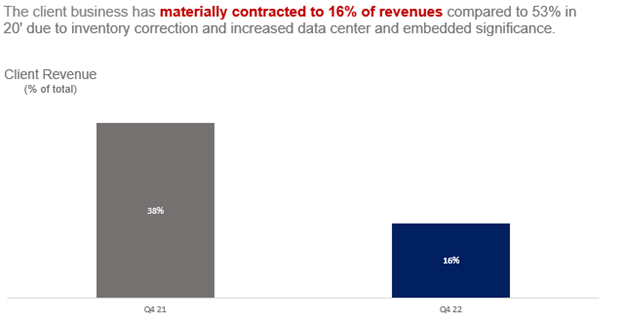

growth Factor 3- Client (PC) and gaming headwinds

AMD’s Client (PC) business has historically been a major portion of the company’s revenues as the consumer PC market was the company’s primary area of business. This was especially the case during 20’ and 21’ when consumer demand for PC’s surged in response to pandemic conditions. The client business continued to face headwinds in Q4 22’ as a result of a material pullback in demand from OEM’s and channel partners due to consumer demand regressing from 21’ levels. This pullback as well as AMD’s strategic advancements in the Data Center and Embedded markets have caused the Client business’ contribution to AMD’s total revenue has decreased materially. While the headwinds were severe in Q4 22’, AMD expects trends to materially improve in Q1 23’ as the business is emerging from the pullback much sooner than peers.

The gaming market is massive with billions of gamers across the world that use both widely available consoles (Playstation, XBox, Nintendo) as well as PC’s fitted to play games requiring high compute power. The market relies heavily on AMD to continuously produce high performance GPU’s that efficiently render high-resolution graphics, which enable and enhance the gaming experience. AMD’s product market fit has made the gaming business a critical component of AMD’s total revenues.

AMD captured significant demand during the pandemic due to a surge in gaming activity. While there have been headwinds due to base effects, this market has been much more resilient than the PC market has been. Additionally, AMD’s leadership position with console manufacturers has generated considerable revenues that have more than offset declines in the core GPU (pc-based gaming) products business. Overall, AMD has maintained the company’s leadership position through continued advancement of the product roadmap.

Demand from the Gaming market continued to weaken primarily driven by inventory rebalancing similar to the Client segment.

The semi-customer business was resilient in the holiday season; however, it was not enough to offset the weakness in the core PC gaming market.

AMD’s recently launched products for the PC gaming market have been experiencing strong adoption, which creates tailwinds for 23’ especially given the low base created in 22’.

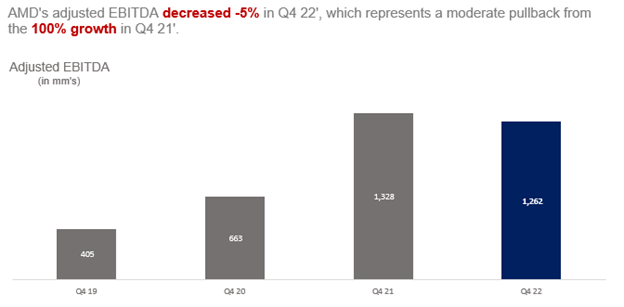

OPERATIONAL EFFICIENCIES

AMD is a highly profitable business with significant efficiencies to be unlocked. The profitability profile has drastically improved due to operating leverage, product mix shift to higher margin products, and ASP increases due to sharp increases in demand. AMD has defied margin stagnation that plagues mature businesses by continuing to deliver high-performance products that command higher ASP’s from increasing numbers of customers. Additionally, management has a laser focus on efficient growth, which is necessary for any business to drive profitability.

AMD’s cost structure is a product of the company’s business model that is based on outsourcing manufacturing in order to focus on developing the most innovation products possible. This translates to COGS being the most significant cost category as AMD relies on other companies to manufacture their chips, which is a highly variable expense. AMD’s focus on development has made R&D the second most significant cost category as AMD continues to increase R&D investments to drive future revenue growth. This is a non-discretionary expense activity as AMD’s business model is based on continuous innovation in the form of regular product performance upgrades. Lastly, AMD does not need to spend as much on SG&A as the business’ brand in the semiconductor industry enables the company to have lean SG&A spend.

In Q4 22’, adjusted gross margin expanded 1ppt due to product mix shift to higher margin Embedded and Data Center products, which carry higher margins than Client and Gaming products. This efficiency was offset by higher opex spend, especially R&D activities as AMD continues to develop next-gen products. Overall, AMD’s cost structure is designed to enable the company to continue driving leverage, which will be derived from continued mix shift to data center and embedded. As a result, the margin compression in Q4 22’ is highly unlikely to persist as it was the result of temporary factors that are already changing in a favorable manner.

INDUSTRY TAILWINDS

The semi-conductor industry experienced a massive boom in 20’ and 21’ that has continued in 22’. This abnormal activity created massive forecasting problems for end-market purchasers, which led to supply build-ups that now exceed the level needed to meet present demand. As a result, inventory corrective actions are being taken in many end-markets such as PC’s, gaming, and even within the data center.

Even still, the semi-conductor CAGR remains well above pre-pandemic levels. Importantly, near-term headwinds are unable to outlast the megatrends that underpin the semi-conductor industry’s critical role in the global economy. These megatrends are all shaped in some way by the massive explosion in data creation, storing, sharing, and consumption. Semi-conductors are needed to facilitate these activities, which creates a powerful flywheel that drives semi-conductors long-term growth. Lastly, leading players are positioned to continue taking share from lagging players as the business that delivers innovation will win much more share than those that fall behind.

Frost and Sullivan is forecasting data center spend (CapEx) to increase 17% in 22’ followed by compounding growth of ~10% through 26’.

Frost and Sullivan is forecasting hyperscale growth to drive most of the data center spend.

Statista is forecasting that network and online gaming users will decrease in the low single digits in 22’ followed by a material return to growth in 23’.

Statista is forecasting that gaming spend will decrease less than usage followed by a much stronger return to growth in 23’.

Gartner is forecasting that PC shipments have decreased -15% in Q3 22’. The market research firm is forecasting shipments to fall -1% in 23’ followed by a 4% increase in 24’.

Gartner is forecasting all of the end-market demand to translate to a 7% increase in 22’ followed by a modest pullback in 23’, which is forecasted to increase over 7% each year from 24’ to 26’.

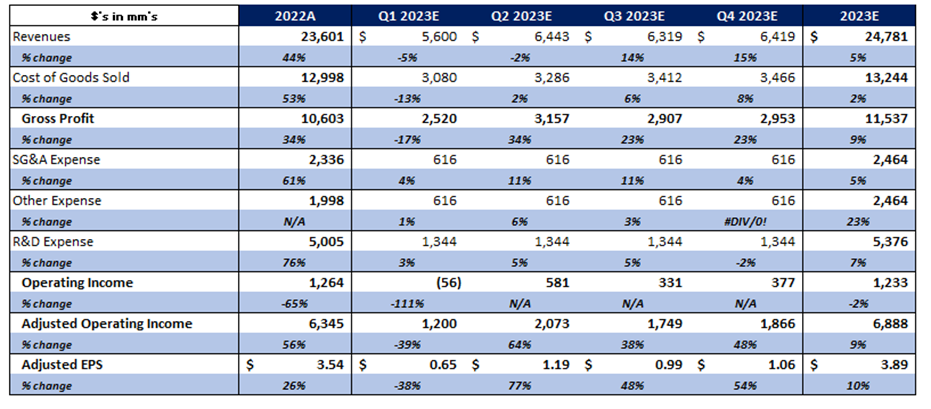

FORECAST AND VALUATION

AMD’s growth in Q1 23’ is likely to reflect the continuation of cross-currents experienced in 2H 22’ with particular weakness in the Client and Gaming segments along with moderate headwinds in the Data Center segment. AMD’s leadership has communicated that the headwinds in the Client segment have likely peaked, which has given confidence in a recovery in Q2 23’. This is highly impactful as the overall PC market is still experiencing a sharp decline as customers continue to order well below consumption in order to rebalance inventory levels. AMD is uniquely positioned to continue taking share even in the contracting market as the business operates at the higher end of the PC market, which has idiosyncratic competitive factors compared to the mass market segment. Additionally, the business is positioned to benefit from adoption of next generation products that were developed while the market was experiencing turmoil in 22’. This forward looking strategy has positioned the business to return to growth as customers look to refresh their inventory with the newest technologies, which encourages end consumers to refresh their respective notebooks and desktops.

While AMD is likely to experience a moderate pullback in the rapidly scaling data center business, this is a temporary headwinds as it is driven by hyperscale data center customers working through inventory on hand. AMD has a great relationship with these major customers who are increasing relying on AMD to advance their own capabilities. Overall, the demand for data center capacity is not reversing as these players are integral to the forward progression of the world. Similar to the Client segment, AMD has released next generation products which have already demonstrated adoption by data center customers. AMD is positioned to return to growth in the Data Center segment as 23’ progresses, especially in the enterprise segment which had a rough 22’. Lastly, AMD is positioned to continue driving growth in the scaling Embedded business as the company continues to introduce next gen products leveraging the combined IP of AMD and Xilinx.

AMD’s efficiency is likely to materially improve in 23’ after absorbing massive headwinds in 22’ due to Client segment headwinds and investments in the product roadmap. While the business will continue investing in the product roadmap in 23’, the relative expense rates are likely to normalize in 23’. Additionally, gross margins are likely to improve as the pricing pressure in various markets ease. While the improvements are welcomed, they will likely not fully offset the weakness in Q1 23’ as the business absorbs the final blow to efficiency. Importantly, the business has material upside in the event that a recovery in the Client segment is more rapid than expected. Also, the base effects in the Gaming segment may not be as strong as expected. Lastly, the Data Center segment has significant upside in the event that macro uncertainties ease, which will encourage hyperscale and enterprise to accelerate CapEx more than expected.

AMD’s stock has increased materially in early 23’ as the business has demonstrated that it is much better positioned to navigate the cross currents than peers, especially Intel. Even still, the stock dooes not reflect the long-term growth potential of the business not does it relfect the material structural evolution the business has delivered on an operational front. AMD’s profit profile is much stronger than it was pre-pandemic; however, the multiple applied to the business’ earnings is still below historical averages. This means that the stock still has significant growth potential as the valuation is reset throughout 23’.